Coronavirus (COVID-19): Community Infrastructure Levy guidance

In response to the spread of coronavirus (COVID-19), MHCLG has published guidance for local authorities on Community Infrastructure Levy matters.

Applies to England

This guidance explains the measures that are available to local authorities to defer CIL and section 106 payments. It has been updated to explain the operation of the ‘Community Infrastructure Levy (Coronavirus) (Amendment) (England) Regulations 2020’ which came into force on 22 July 2020.

Overview

The government has put in place a number of financial measures to help businesses during the COVID-19 outbreak which are explained on the financial support for business pages. However, it is recognised that smaller developers may need more help. This guidance explains the steps that local authorities may wish to consider to ease the financial burden on developers, including recent changes to the CIL Regulations, to help small and medium sized developers in particular.

The Community Infrastructure Levy Regulations 2010 (as amended) provide some flexibility for local authorities to defer the payment of CIL. We set out in May 2020 some of the steps that local authorities may wish to consider to ease the burden on developers. However, it was recognised that under the regulatory regime at that time, delaying payment would result, in some cases, in mandatory interest charges for the late payment of CIL.

To address this, the government has amended the Community Infrastructure Levy Regulations 2010 through the Community Infrastructure Levy (Coronavirus) (Amendment) (England) Regulations 2020 to give authorities discretion, for a limited period, to defer CIL payments for small and medium sized developers without having to impose additional costs on them. The regulations came into force on 22 July 2020 and are explained below.

Instalment policies

CIL charging authorities have the power under regulation 69B to allow those liable to CIL to pay the charge in one or more instalments and can set the date(s) on which each payment is due. This could be some time in the future. In the absence of such a policy, CIL is payable – in full – at the end of the period of 60 days beginning with the intended commencement date (see regulation 70(7)).

CIL charging authorities can also bring into effect a new instalment policy at any time. However, any new instalment policy will only apply to chargeable developments commencing after the new instalment policy comes into effect. CIL is therefore payable in accordance with the instalment policy that was in place at the time of commencement of the chargeable development.

For phased development, as each phase is a separate chargeable development, later phases that have not yet commenced could be subject to a new instalment policy. CIL charging authorities could therefore take advantage of this provision to introduce new instalment policies for as-yet un-commenced chargeable development.

Enforcement

CIL collecting authorities have discretion around how they deal with the late payment of CIL. This could provide some scope to ease the financial pressures on developers.

In normal circumstances, a CIL collecting authority might consider it expedient to stop development until the outstanding amount has been paid. The CIL regulations set out the procedure for issuing a CIL stop notice, contravention of which is an offence. However, decisions regarding whether and when to take such enforcement actions are at the discretion of the collecting authority.

Similarly, a CIL collecting authority has the ability under regulation 85 to impose surcharges on a person that has not paid CIL. However, the imposition of these surcharges is at the discretion of the authority. CIL collecting authorities can therefore choose not to impose the surcharge for late payment and are encouraged to consider using this discretion where appropriate.

However, the CIL regulations provide that late payment interest accrues automatically, starting from the day after the day payment was due (see regulation 87). The payment is calculated at an annual rate of 2.5% above the Bank of England base rate.

The amendments to CIL introduced by the Community Infrastructure Levy (Coronavirus) (Amendment) (England) Regulations 2020 enable charging authorities to defer CIL payments; to temporarily disapply late payment interest and surcharge payments; and to provide a discretion to credit interest already charged where they consider it appropriate to do so. This may include interest that accrued in the period between the introduction of the lockdown and the regulatory changes coming into effect.

The measures now available to CIL authorities should give them confidence to use their enforcement powers with discretion and provide some comfort to developers that, where appropriate, they will not be charged extra for matters that were outside of their control.

CIL charging authorities are therefore encouraged to consider making use of the ability to introduce an instalment policy (or amend an existing instalment policy); to use their discretion in considering what, if any, enforcement action is appropriate in respect of unpaid CIL liabilities; and to take a positive approach to their engagement with developers, to ensure CIL liabilities do not cause undue burdens over the period of disruption caused by the coronavirus

Community Infrastructure Levy (Coronavirus) (Amendment) (England) Regulations 2020

What is the purpose of this guidance?

This guidance explains the changes made to the Community Infrastructure Levy Regulations 2010 introduced by the Community Infrastructure Levy (Coronavirus) (Amendment) (England) Regulations 2020 (the ‘CIL Coronavirus Regulations’).

The CIL Coronavirus Regulations were introduced to supplement the financial measures that the government has put in place to help small and medium sized businesses during the coronavirus outbreak. They give CIL charging authorities the discretion, for a limited time (in certain prescribed circumstances and if it is considered appropriate), to defer CIL payments, and to disapply late payment interest. There is also discretion to credit interest already charged to developers.

The regulatory changes and this guidance apply to England only.

Find further guidance on other support measures that the government is providing for businesses.

When does the guidance come into effect?

This guidance came into effect on 22 July 2020 when the Community Infrastructure Levy (Coronavirus) (Amendment) (England) Regulations 2020 came into force. The guidance will remain in place until further notice but will extend beyond the end of the ‘material period’ on 31 July 2021 as payment deferral periods can extend beyond that date.

What does this guidance cover?

The guidance applies to all local planning authorities in England who charge CIL including the Mayor of London (the CIL charging authorities) and County Councils who otherwise only collect CIL in regard to development for which they grant planning permission, as well as individuals, and small and medium size developers. It provides guidance on how relevant CIL payments should be treated during the Coronavirus pandemic. It covers:

- the deferral of CIL payments

- disapplying late payment interest

- crediting interest already charged to developers

- how the CIL Coronavirus Regulations impact on the collection of Mayoral CIL in London

Who does the CIL payment deferral apply to?

The CIL payment deferral provisions apply, temporarily, to small and medium sized developers (SMEs) with an annual turnover not exceeding £45 million. Any such SME who is (i) experiencing financial difficulties because of the effects of coronavirus and (ii) having difficulty paying an amount of CIL (whether by instalment or otherwise) which is due (required to be paid) during the material period, may ask the CIL collecting authority to defer that CIL payment. This may include payments that became due before the start of the ‘material period’ and are still outstanding (such that the CIL amount is required to be paid during the material period).

What is the ‘material period’

A CIL payment must be due during the material period - which is the period starting on 22 July 2020 (i.e. when the regulations came into force) and ending at midnight on 31 July 2021. A deferral request can be made in respect of such a payment if the other criteria mentioned in regulation 72A(1) are also met. A CIL payment deferral request can be made in respect of a CIL payment that became due prior to the ‘material period’, and which has not been previously paid so that it remains due during the material period.

Must the CIL payment be due during the ‘material period’?

A deferral request for a CIL payment can be made in respect of CIL payments that are due (required to be paid) during the ‘material period’, and CIL payments that became due prior to the ‘material period’ which have not previously been paid and remain payable within the ‘material period’.

The CIL payment deferral process

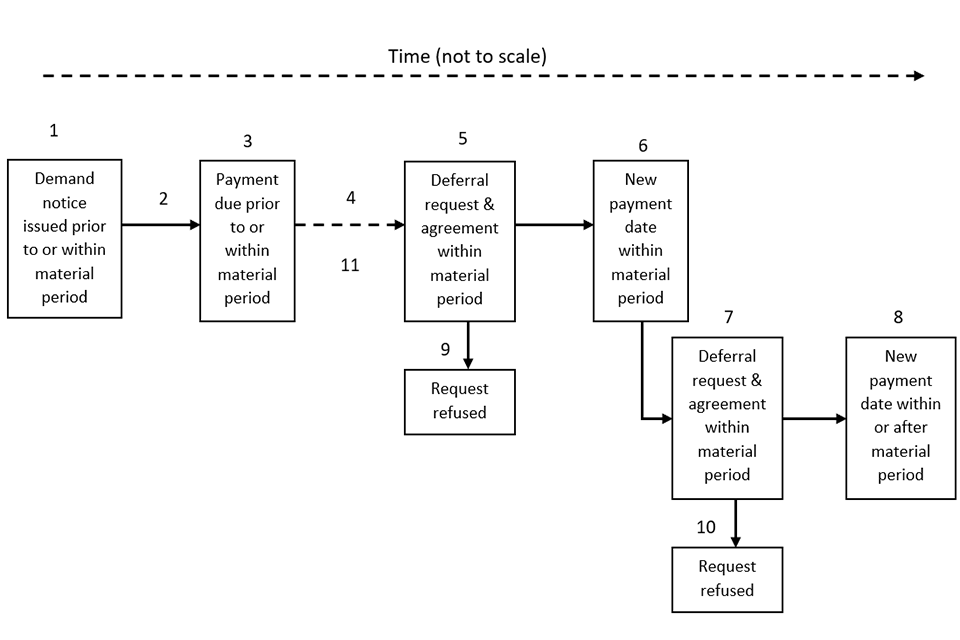

Figure 1. Illustration of the deferral process (see key below for a detailed explanation of the stages)

Key to Figure 1

Actions relevant to CIL Coronavirus Regulations coming into force

1. The demand notice is issued under regulation 69 of the CIL Regulations stating the intended commencement date, the amount payable and the day on which payment is due. Where the amount is payable by instalments, the demand notice should state the amount of each instalment and the day on which payment of each instalment is due.

2. The payment period is normally 60 days beginning with the intended commencement of the development - unless it is subject to an instalment policy (regulation 70).

3. The regulations could apply to any SME CIL payment that is required to be paid during the material period including those that fell due before lockdown (21 March 2020) and remain outstanding payments in the material period. The other criteria mentioned in regulation 72A must also be met.

4. Where the original payment date occurred before the regulations come into force, a deferral request must be made as soon as practicable after the regulations are in force. Late payment interest will have accrued. See step 11 for an explanation of the process for requesting a credit for the late payment interest. Where the initial payment date is after the regulations come into force, a deferral request should be made no earlier than 14 days before the payment due date occurs, or as soon as practicable after the payment is due.

Submitting a deferral request and consideration by the CIL collecting authority

5. CIL collecting authorities have the discretion, under the CIL Coronavirus Regulations, to defer CIL payments (regulation 72A), to disapply late payment interest and surcharge payments; and to credit interest already charged to developers (regulation 72B). The developer should make a deferral request to the collecting authority, in writing, no more than 14 days before, or as soon as practicable after the date the CIL payment is due. The collecting authority can request whatever information from the developer they reasonably need to consider the deferral request. The developer must provide that information, in so far as it is in their possession or control, within 14 days beginning with the day on which the request was made. The collecting authority can refuse to grant a request if the information is not provided within the specified time (regulation 72C).

The collecting authority must consider a deferral request as soon as practicable after it is received, and grant or refuse to grant the request in writing as soon as practicable, and in any event before the end of the period of 40 days beginning with the day the collecting authority receives the request. The collecting authority cannot charge late payment interest or a surcharge while they are considering the request, or in the case of a refusal to grant a payment deferral, for 7 days after (see step 9 below).

6. The collecting authority may grant a deferral request if it considers it is appropriate to do so and for no more than 6 months beginning with the day the authority receives the request in writing; and in that case the authority must serve a revised demand notice under regulation 69(3) which states the amount of CIL payable and the day on which the payment is due, taking account of the deferral that is agreed. This should also include any surcharges imposed in respect of, or interest applied to, the amount (see step 4 above).

7 and 8. If the new payment date is within the ‘material period’ the developer could submit a further deferral request if the criteria mentioned in new regulation 72A(1) are fulfilled again. The procedure and timing is again as set out in points 5 and 6 above.

Refusal of a CIL deferral request

9. If the collecting authority refuses to grant a deferral, the developer has 7 days, beginning with the day on which the deferral request is refused, to make their CIL payment (regulation 72B(2)). This should include any late payment interest and surcharge that accrued prior to the deferral request being made (see point 4 above).

10. The collecting authority can refuse to grant any further deferral if they consider it appropriate to do so. In that case the developer must make their CIL payment within 7 days of the deferral request being refused.

Requesting a credit for late payment interest

11. If a deferral request is granted for a CIL payment that had accrued late payment interest within the period beginning with 21st March 2020 and ending with the day before the collecting authority receives that deferral request, the developer can request that that the late payment interest is credited against the CIL amount due under the revised demand notice which is required under regulation 72B(3) (“an interest request”). An “interest request” cannot be made if the deferral request is refused. In this case, the collecting authority can issue a new demand notice under regulation 69 which includes the late payment interest (and where appropriate the late payment surcharge) (see regulation 72A(8)(b)).

What evidence is required to support a deferral request?

The CIL Coronavirus Regulations do not prescribe a particular format for a deferral request, except it should be in writing and received no more than 14 days before, or as soon as practicable after the date on which the CIL payment is due. The provisions only apply to people or businesses that have an annual turnover not exceeding £45 million and are experiencing financial difficulties for reasons connected to the effects of coronavirus and are having difficulty paying a CIL amount during the material period.

Applicants are encouraged to engage with the collecting authority at the earliest opportunity to discuss what relevant information they should provide, but as a minimum they should supply a copy of the relevant demand notice, and where there is likely to be any doubt, evidence that they have an turnover not exceeding £45 million and that they are experiencing financial difficulties as a result of the coronavirus.

The collecting authority can request (in writing) that the applicant supplies relevant information to assist them when deciding whether to grant a deferral (see regulation 72C). The applicant must provide any information that is requested, in so far as that information is in their possession or control, within 14 days beginning with the day on which the request is made. Failure to provide the requested information within the specified time can result in refusal to grant a deferral.

Examples of evidence in support of the annual turnover can include:

- A declaration from a responsible person or organisation, such as a chartered accountant or auditor. This can set out what the turnover is and whether the business meets the criteria of sole enterprise or is part of a linked business or has partners. See “What is ‘turnover’ for the purpose of checking the eligibility for applying for a CIL payment deferral?”

- Information provided to Companies House including the company’s confirmation statement (annual return).

The collecting authority should consider the evidence provided by the applicant and ensure that it satisfies the criteria laid out in Regulation 72A. The collecting authority may also wish to take further evidence into account if they consider that is relevant and reasonable. Any additional information that the collecting authority reasonably wishes to consider, which goes beyond the scope of the criteria as set out in the 2020 Regulations, should be publicised at the earliest opportunity on the authority’s website.

What is ‘turnover’ for the purpose of checking the eligibility for applying for a CIL payment deferral?

If it is a sole enterprise it is the turnover of the applicant only, as shown in the latest set of accounts. For applicants acting as part of a group, that have partners or linked enterprises, the turnover assessment should take the latest turnover of the applicant, as shown in their accounts, together with the turnover of any linked enterprises, any partners of any linked enterprises, any enterprises linked to any of the applicant’s partners and any enterprise linked to the applicant’s linked companies.

What is a “sole enterprise”?

A sole business is one that holds no more than 25% of the capital or voting rights (whichever is higher) in one or more other businesses; and/or other businesses hold no more than 25% of the capital or voting rights (whichever is higher) in them; or it is not linked to another business according to the criteria for “linked enterprises”.

In addition, certain investors may individually have a stake of up to 50% in the business and it may still be considered a sole business: public investment corporations, venture capital companies and business angels (provided the investment is less than €1.25 million), universities and non-profit-making research centres, institutional investors, (including regional development funds), or autonomous local authorities (with an annual budget of less than €10 million and fewer than 5,000 inhabitants).

What is a “linked” business?

Linked businesses form a group by controlling the majority of voting rights of an enterprise, either directly or indirectly; or being able to exercise dominant influence over an enterprise.

Enterprises are linked when one holds a majority of the shareholders’ or members’ voting rights in another; or can appoint or remove a majority of the other’s administrative, management or supervisory body; or there is a contract between them enabling one to exercise a dominant influence over the other; or one can exercise sole control over a majority of shareholders’ or members’ voting rights in another. A typical example is a wholly owned subsidiary.

An enterprise is indirectly linked to a business if it is directly linked to an enterprise that is linked directly to the business.

What is a “partner” business?

A “partner” business is an enterprise that has certain financial partnership with another, without one exercising effective direct or indirect control over the other. They are not sole enterprises or linked enterprises.

This is the case where both hold 25% or more of the capital or voting rights in each other; and are not linked to other enterprises. Among other things, their voting rights in each other do not exceed 50%.

What are the responsibilities of the collecting authority?

Where an application has been made to defer a CIL payment, the collecting authority must consider it as soon as practicable after the application has been received. The authority has a maximum of 40 days to consider the application and notify the applicant of its decision to allow or refuse the payment deferral, in writing. The 40-day period starts from the day that the collecting authority receives the request for a payment deferral.

Late payment interest and surcharges cannot be charged while the collecting authority is considering a deferral request.

The government expects collecting authorities to take a positive approach when considering a deferral request. This new regime is intended to be a quick route to allow developers more time to make CIL payments for a limited period of time. The government expects this regime will be administered quickly and fairly in everyone’s interests.

Where there are questions around the eligibility of an applicant, the collecting authority should engage with the applicant as soon as practicable to establish whether it would be appropriate to approve a deferral at an early stage and look to provide a degree of certainty to the applicant.

Where the collecting authority considers it to be appropriate, a payment deferral may be granted for up to 6 months from the day that the deferral request was received.

Where a payment deferral has been granted, the collecting authority should issue a revised demand notice under Regulation 69(3). The revised demand notice should set out the total amount of CIL to be paid (including any late payment interest and surcharges that accrued before the deferral request was made) and the date that it should be paid. See also Can late payment interest be waived?

Where a payment deferral has been refused, the collecting authority should notify the applicant as soon as practicable, and no later than 40 days after receipt of the request. The applicant must then comply with the demand notice that was served under regulation 69 before the deferral request was made; or where applicable, any revised demand notice which was served after the deferral request was made but which is not related to that deferral request. Payment must be made within 7 days to avoid late payment interest. The legislation does not mandate that an authority must give reasons for refusing a deferral request, but the government expects that as a matter of good administrative practice, reasons should be provided wherever possible and reasonable to do so.

Can a local authority signal an intention to defer prior to the formal deferral being granted?’

The CIL collecting authority and developer are encouraged to engage at an early stage and agree what evidence the developer should provide in support of their deferral request. The local authority is able to signal their inclination to grant a deferral in advance, although a deferral request must be formally applied for as soon as practicable after, or not earlier than 14 days before, the date on which the CIL payment is due.

Can a CIL payment be deferred more than once?

If a deferred CIL payment becomes due during the ‘material period’ the applicant can apply for a further deferral for the same chargeable amount if the criteria mentioned in regulation 72A apply again.

The applicant should make their new deferral request no earlier than 14 days before, or as soon as practicable after the CIL payment due date. The latest time for submission of a deferral request would be as soon as practicable after 31 July 2021 – which should be days or a few weeks after that cut-off date (not months). The collecting authority should determine that the applicant still meets the eligibility criteria and can grant a further payment deferral of up to 6 months – even if this means the deferred payment date is after 31 July 2021.

Can late payment interest be waived?

The collecting authority cannot charge late payment interest while it is determining a deferral request, and also during the agreed deferral period, late payment would not apply. However, there will be many cases where late payment interest accrued in the period between the start of lockdown (21 March 2020) and the CIL Coronavirus Regulations coming into force. The collecting authority must charge this interest in accordance with regulation 87, but the applicant may request that the collecting authority credits that interest payment against the CIL amount due under the revised demand notice which is required under regulation 72A(5). This is called “an interest request”. Late payment interest that accrued before 21 March 2020 cannot be credited against the CIL amount due.

However, if the collecting authority does not consider the interest request to be appropriate and refuses it, the applicant will be liable to pay the outstanding interest amount in accordance with the existing CIL Regulations 2010 (as amended).

Are surcharges payable for late payment?

Regulation 85 provides that the collecting authority may impose a surcharge where a person is liable to pay CIL and this amount is not received in full after the end of the period of 30 days beginning with the day on which the payment is due. The provision is therefore already discretionary and is unchanged by the CIL Coronavirus Regulations. The one change introduced by the CIL Coronavirus Regulations is that a surcharge cannot be imposed while the collecting authority is determining a deferral request (Regulation 72B(1)).

Is there a right of appeal again the refusal to grant a deferral or to credit late payment interest?

The CIL charging authority has the discretion to grant a deferral request and to credit interest, if it considers that is appropriate. Charging authorities are encouraged to take a positive approach, and public law principles apply as this is an exercise of discretion, but there is no right of appeal in CIL Regulations, if the decision is taken to refuse the request.

Can collecting authorities in London defer Mayoral CIL and grant interest requests?

Collecting authorities in London are required to collect CIL on behalf of the Mayor. They may only grant a deferral request for Mayoral CIL if the Mayor is of the view that it is appropriate for any CIL payment charged by the Mayor to be deferred (regulation 72A(6)).

In relation to interest which has accrued on CIL charged by the Mayor, the collecting authority may only grant an interest request, if (i) the Mayor is of the view that it is appropriate for any CIL payment charged by the Mayor to be deferred under regulation 72A (see regulation 72B(4) and (ii) if the Mayor is of the view that it is appropriate for any late payment interest which has accrued on Mayoral CIL to be the subject of an interest request.

Section 106

There are greater flexibilities within section 106 planning obligations than CIL. Where the delivery of a planning obligation, such as a financial contribution, is triggered during this period, local authorities are encouraged to consider whether it would be appropriate to allow the developer to defer delivery.

Deferral periods could be time-limited, or linked to the government’s wider legislative approach and the lifting of CIL easements (although in this case we would encourage the use of a back-stop date). Deeds of variation can be used to agree these changes. Local authorities should take a pragmatic and proportionate approach to the enforcement of section 106 planning obligations during this period. This should help remove barriers for developers and minimise the stalling of sites.

Updates to this page

-

Updated to explain the operation of the ‘Community Infrastructure Levy (Coronavirus) (Amendment) (England) Regulations 2020’ which came into force on 22 July 2020.

-

This guidance has been updated to explain the operation of the Community Infrastructure Levy (Coronavirus) (Amendment) (England) Regulations 2020 which were laid on 30 June 2020 and will come into force later in the summer. This guidance will be finalised when the regulations come into force.

-

First published.