Land and building collection tool: leased asset guidance

Updated 26 November 2024

Applies to England

1. Background for leased asset requirements

The DfE, as part of the consolidated sector annual report and accounts for academies, must follow IFRS 16 as part of its accounts preparation. To do so we need to ask academy trusts for some extra details as part of the Land and building collection tool (LBCT) return that is not included in the accounts return data we collect. Academy trusts should follow the accounting standards as set out in the Academy Accounts Direction, you do not need to apply IFRS 16 as part of your accounts preparation.

All data previously collected will be pre-populated as part of your following years LBCT return.

2. Leased assets section: what’s a lease agreement

Leases under IFRS 16 are contracts that give you the right to use a specific asset (the underlying asset) for a period of time in return for consideration.

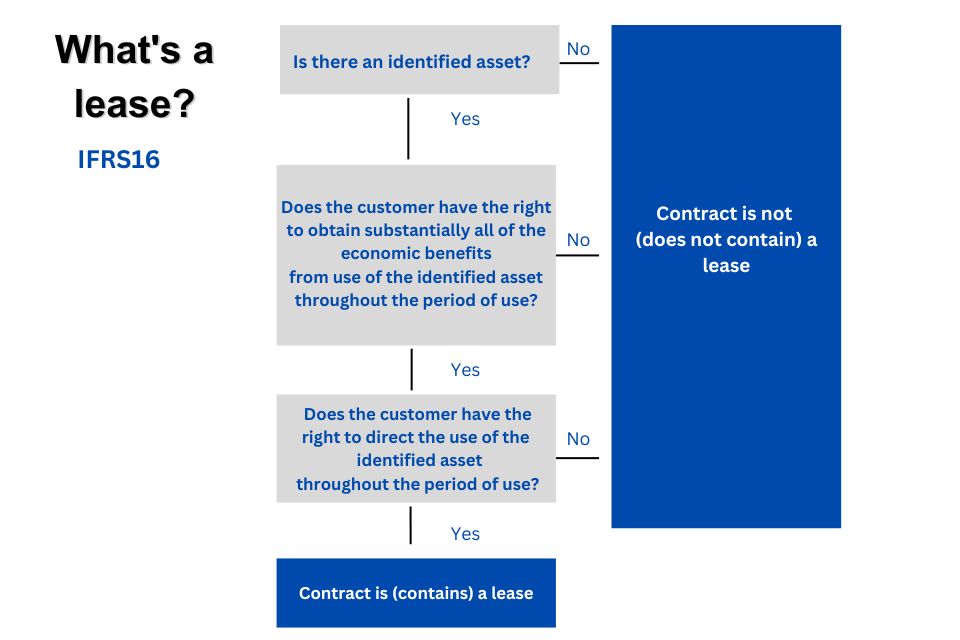

To be classified as a lease under IFRS 16, the contract must follow the below criteria:

IFRS16 criteria to recognise a lease agreement

To see how this would look in the form, visit our ‘leased assets scenario’ example 1.

3. How we collect this information

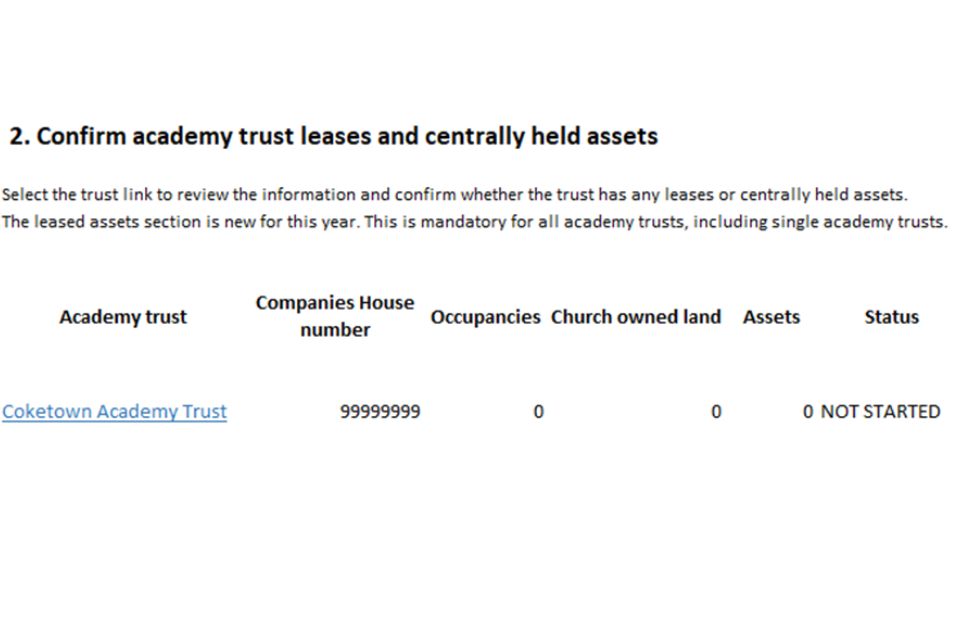

This information is collected via ‘leased assets’ section within the ‘Centrally held assets and leases’ part of the LBCT form. (See below diagram)

Confirm academy trust leases and centrally held assets section

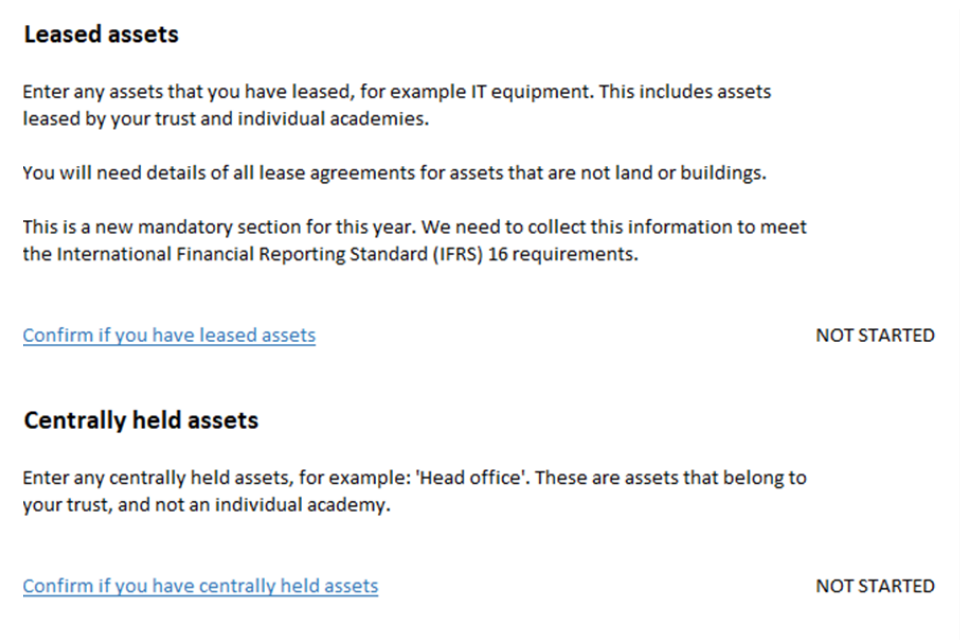

When you click the trust link in the form (as shown in the above diagram), you are taken to the next page which contains the leased assets and centrally held asset sub-section (as shown in the below diagram).

Leased assets and Centrally held assets sub-sections

Click the ‘Confirm if you have leased assets’ link and work through the pages to provide information about any leased assets that you may have, both at trust and academy level.

4. What information do I need to provide

Before starting, we recommend to watch the Leased asset video tutorial for the section where detailed all the requirements.

If you’re experiencing issues watching the video tutorial, allow cookies on GOV.UK first.

You need to tell us about any leased tangible assets you have at 31 August 2024 that are not land and buildings at both academy and trust level.

For some asset categories (deemed to be low value assets), we only require the number of lease contracts held per category at trust or academy level.

The diocese checker will not be required to review any of the information entered in the leased asset section of your return.

5. Asset categories included

How to fill out the asset category page- video tutorial

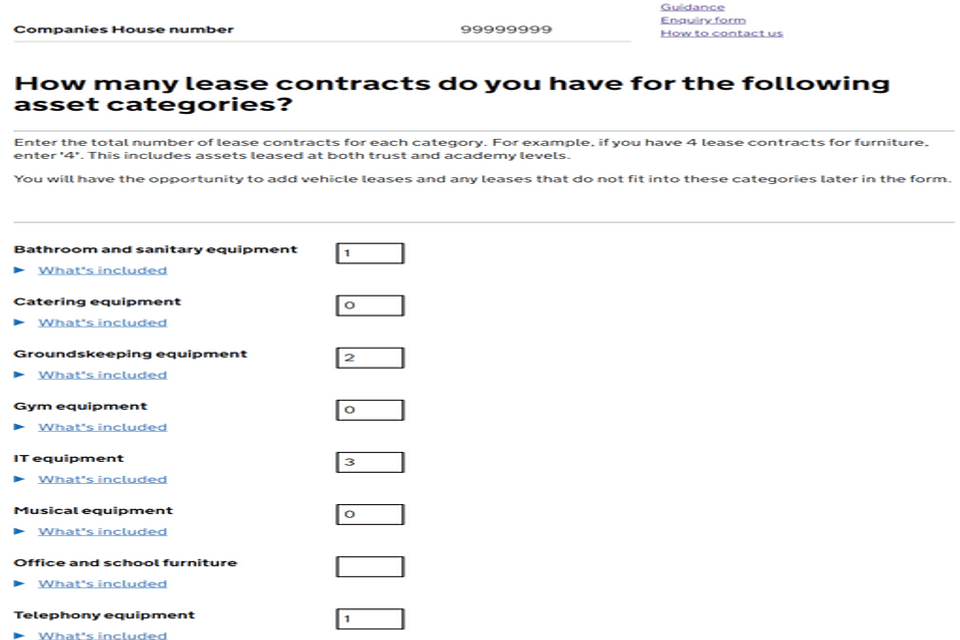

For the asset groups below, you only need to tell us how many leased asset contracts are in place at 31 August 2024 across the entirety of the trust.

You do not need to tell us the number of assets or who uses them (that is, trust, academies or both). Also, for these categories, you do not need to upload copies of agreement.

As an example, if you have 1 lease for 300 laptops and 1 for 25 whiteboards, enter 2 in the ‘IT equipment’ category. Similarly, if you have 1 contract for lawnmowers, string trimmers and salt spreaders, enter 1 in the ‘Groundskeeping and Equipment’ category. Enter 0 if you do not have any lease contracts for the specified category.

| Asset Category | What’s included |

|---|---|

| Bathroom and Sanitary Equipment | Hand dryers, towel dispensers, sanitary bins |

| Catering Equipment | Tills, water coolers, vending machines, dishwashers, washing machines, ovens, fridges, freezers, water boilers, small kitchen appliances (toasters, coffee machines, microwaves, kettles etc.), crockery and cutlery |

| Furniture | Tables, chairs, benches, desks |

| Groundskeeping Equipment | Lawn mowers, string trimmers, leaf blowers, salt spreaders |

| Gym Equipment | Treadmills, free weights and weight machines, rowing machines, exercise bikes |

| IT equipment | Laptops, tablets, desktop computers, printers, photocopiers, servers, door entry security systems, CCTV Systems, whiteboards and touch screen boards, franking machines |

| Musical Instruments | Orchestral equipment, keyboards, guitars |

| Telephony | Mobile phones, landline phones, telephone systems |

If you have leased software, intellectual rights for teaching materials or any other type of intangible assets such as music performance rights etc. these are excluded from this collection.

6. Vehicle and other leased assets

Recording vehicle and other leases on the leased asset section-video tutorial

If you have leased any type of vehicle or if you have another type of asset that does not fit into any of the above categories, you will need to provide more details about the lease contracts.

You will only need to upload the individual lease agreement documents for vehicle and other asset categories.

This can be in PDF, JPEG, GIF or PNG format and will need to be less than 23MB in size.

The following are examples of what’s included in these 2 categories.

| Asset Category | What’s included |

|---|---|

| Vehicles | Minibuses, quad bikes, coaches, buses, or cars |

| Other | Wind turbines, LED lighting systems, EV charge stations etc. |

We will ask you:

- how many assets are included in the lease contract (note, if you lease 10 assets in 1 lease contract you only need to provide the details once)

- description of what you lease

- who uses the assets (that is, trust only, trust and academies, multiple academies or a single academy)

- monthly lease payment (excluding VAT)

- lease start and end dates

- lease agreement document

Note: printers or any other similar device agreement will fall on the IT equipment category illustrated above where no agreement evidence needs to be uploaded.

When all leased assets have been added, check the information via the summary review page. At this stage you can still edit and delete data.

Once confirmed, the status of the leased assets section will change to ‘completed’ on the trust index page.

When the status of both the ‘leased assets’ and ‘centrally held assets’ sections on the trust index page are showing as ‘completed’, after a final review of both sections, the ‘Send to approver’ button can be clicked.

The status of the trust link in the ‘Confirm academy trust leases and centrally held assets’ section on the dashboard will then change to ‘Sent to approver’.

7. Service agreements

There may be instances where a leased asset includes a service agreement, for example:

-

you lease an industrial grass cutter and as part of the agreement, the grass is cut and applications of herbicide for weed control are included

-

you lease a vehicle which includes free servicing

In these instances, enter the lease details in the relevant category and include a brief description of what the service agreement is in the ‘Lease description’ comments box.

8. Other scenarios

8.1 Salary sacrifice car scheme

If your trust has a salary sacrifice EV car lease scheme, where employees lease a car using the trust’s lease car supplier. The monthly lease rental payments are collected from their salary and paid across to the lease company by the trust. In this instance, the employee is the lessee, and the lease company is the lessor. The trust themselves are not a lessee and do not need to tell us about vehicles provided to employees under this arrangement. More information can be found inthe Academies trust handbook - section 2.31.

8.2 Smart meters

If your trust or academy have smart meters provided by a utility company, as part of a service being delivered, these are usually owned by the utility company, and they have the right to remove the smart meter when your trust or academy changes provider. You do not have to pay any charge for the use of the smart meter and as such there is no lease arrangement in place here. Under these circumstances, trusts do not need to tell us about smart meters.

8.3 Solar panels

Your academy may lease out space on their roof to a third party who then installs solar panels. In this instance the academy is acting as a lessor and would be required to report a sub-lease in the building part of their LBCT return. You do not have to report this arrangement in the leased assets section of the form.

Only in the instance that your academy has leased a solar panel from a third party and had it installed on your roof space would you need to include this. This would need to be included in the ‘leased assets’ section of the form under the question ‘Have you leased any other assets that do not fit into the previous categories?’

8.4 Purchase of leased asset

If you had a lease that you’ve subsequently purchased outright before 31 August 2024, this does not need to be recorded in your return. We only require information about any assets you lease at 31 August 2024.

If you’re not sure whether to report a leased asset or not, we recommend you include it and provide a meaningful description. In addition, if you have any question or need any help to complete the ‘leased assets’ section, see ‘how to contact us if you have queries’.

You can see examples of how to deal with leased assets in our case studies section.

9. Uploading lease agreements

How to upload lease agreement into the leased asset section- video tutorial

Remember that copies of the lease agreement will be required for only ‘Vehicles’ and ‘Other’ categories. No documents need to be uploaded for the leases categories listed above.

If you experience any issues in uploading the documents, check that:

- it’s in the right type of file format, that is PDF, JPEG, GIF or PNG

- the file size is smaller than 23MB

If you are still having difficulties uploading the documents, contact us via customer help portal.

10. Leased assets case studies

IFRS 16 is a new International Financial Reporting Standard for lease accounting which has replaced IAS 17 accounting standard. Academy trusts must provide details of all lease agreement for assets that are not land or buildings.

10.1 Example scenario 1

Coketown MAT is made up of 11 academies. It has the following non-land and building asset lease contracts at both trust and academy levels.

- lawn mower lease

- salt spreader lease

- laptop, tablet, and desktop computer lease

- photocopier lease

- whiteboard lease

- mobile phone lease

- hand dryers, towel dispenser and sanitary bins lease

10.2 How to record on the LBCT

In response to the question ‘Have you leased any assets that are not land or buildings’ answer ‘yes’ and complete the following page as per the screenshot below. This is based on the principle that lawn mowers and salt spreaders come under the ‘Groundskeeping equipment’ category so the user would enter ‘2’ – and so forth.

Non-land and building assets contract page

10.3 Example scenario 2

Coketown MAT is made up of 11 academies. It has the following non-land and building asset lease contracts for both trust and academy levels:

- treadmills, free weights and weight machines, rowing machines

- tables

- franking machines

- kitchen appliances

- orchestral equipment

- vehicles

- EV charging equipment

10.4 How to record on the LBCT

Record the first 5 contacts as per scenario 1.

The form will then ask if you lease any vehicles, this includes minibuses, coaches, buses or cars. Answer ‘yes’ and complete the questions on the next page. You will then be asked if you lease any other assets that do not fit into any of the previous categories. Again, enter ‘yes’ and complete a similar set of questions for the EV charging equipment.

11. How to contact us if you have queries

If you have any questions about the LBCT return, you can contact us using our customer help portal.