Practice guide 35: corporate insolvency

Updated 16 September 2024

Applies to England and Wales

Please note that HM Land Registry’s practice guides are aimed primarily at solicitors and other conveyancers. They often deal with complex matters and use legal terms.

1. Introduction

This guide gives advice on the land registration aspects of transactions by liquidators of companies registered under the Companies Acts. It describes the evidence that will be required by HM Land Registry when a company that is the proprietor of a registered estate is in liquidation. It explains how the appointment of a liquidator may be entered in the register. It gives guidance on the dispositions that may be made by liquidators, including distributions in specie. Finally, it considers the situations that will arise where a registered estate is disclaimed by the liquidator, and where a company remains in the register as proprietor of a registered estate after its dissolution.

Since 8 December 2017, the insolvency processes for a limited liability partnership mostly mirror those available to insolvent companies, so in this guide, the expressions “company” or “corporate body” may be read (on or after 8 December 2017) as including limited liability partnerships. (However, the Insolvency Rules 1986 still apply to limited liability partnerships where a petition for administration was presented before 15 September 2003.)

For insolvency of a charitable incorporated organisation, see practice guide 14A: charitable incorporated organisations.

Amendments to liquidation processes, with effect from 6 April 2017, were made by the Insolvency (England and Wales) Rules 2016 (as amended by the Insolvency (England and Wales) (Amendment) Rules 2017. Transitional provisions apply.

1.1 Retention of documents lodged with applications

Original documents are only normally required if your application is a first registration.

A conveyancer may, however, make an application for first registration on the basis of certified copy deeds and documents only. For information about this, see practice guide 1: first registrations – Applications lodged by conveyancers – acceptance of certified copy deeds.

If your application is not a first registration, we will only need certified copies of deeds or documents you send to us with HM Land Registry applications. Once we have made a scanned copy of the documents you send to us, they will be destroyed. This applies to both originals and certified copies.

However, any original copies of death certificates or grants of probate will continue to be returned.

2. Evidence of liquidation

2.1 Introduction

To establish that a company is in liquidation and that a liquidator has been appointed, you need to produce evidence to HM Land Registry. The later parts of this guide identify the occasions when you will need to do this. The nature of the evidence varies according to the type of liquidation, as explained in the following paragraphs.

2.2 Certification of copy documents

Copy documents or orders of the court mentioned below will need to be certified as true copies before being sent to us (rule 214 of the Land Registration Rules 2003). This may be done, for any document, by the liquidator or by their conveyancer. Copies of resolutions passed at company’s meetings may be certified by the company secretary or by its conveyancer. To find out what happens to documents submitted with application forms, see Retention of documents lodged with applications.

2.3 Members’ voluntary winding up

The evidence that we require in the case of a members’ voluntary winding up is either:

- (i) a certificate, by the secretary of the company or by the liquidator or by a conveyancer acting for the company or the liquidator, that a statutory declaration of solvency complying with the requirements of section 89 of the Insolvency Act 1986 has been filed with the Registrar of Companies; or

- (ii) Companies House form LIQ01 and one of:

- a certified copy of the resolution passed by the general meeting of the company appointing the liquidators (under section 91(1) of the Insolvency Act 1986)

- (before 8 December 2017) a copy of the notice of the liquidator’s appointment in Companies House form 600 or (on or after 8 December 2017) Companies House form 600CH

2.4 Creditors’ voluntary winding up

The evidence that we require in the case of a creditors’ voluntary winding up is a certified copy of the resolution passed at the company’s general meeting (sometimes called the ‘members’ meeting’) resolving that the company be wound up (under section 84(1) of the Insolvency Act 1986) and appointing the liquidator, and one of:

- (before 8 December 2017) a certified copy of the notice of the liquidator’s appointment in Companies House form 600 (on or after 8 December 2017) Companies House form 600CH

- (before 8 December 2017) a certified copy of the resolution passed at the creditors’ meeting appointing the liquidator (under section 100(1) of the Insolvency Act 1986)

- a certificate by the liquidator appointed at the company’s general meeting, or by their conveyancer, that a meeting of the creditors was duly held in accordance with section 98(1) of the Insolvency Act 1986 and that the creditors’ meeting either confirmed the appointment of the liquidator by the company’s meeting or did not pass a resolution nominating a liquidator (If the general meeting of the company and the creditors’ meeting nominate different liquidators, the person nominated by the creditors will act unless an order is made by the court on an application made within 7 days of the creditors’ nomination – sections 100(2) and (3) of the Insolvency Act 1986.)

- (on or after 8 December 2017) either (i) a copy of Companies House form 600CH or (ii) a copy of the creditors’ decision notice (certified as a true copy by the liquidator or their conveyancer) or (iii) a certificate by the liquidator or their conveyancer that the liquidator’s appointment was confirmed by a creditors’ qualifying decision procedure or deemed consent procedure. Note: Form 600CH is to be used for appointments made on or after 8 December 2017 for companies registered in England and Wales. Use form 600 for appointments made before 8 December 2017, and for companies registered in Scotland.

It is possible for a company to move directly from administration into a creditors’ voluntary winding up (paragraph 83 of Schedule B1 to the Insolvency Act 1986). In that case, where the move occurred on or after 6 April 2017, instead of the evidence specified above, we require evidence which complies with the requirements of rule 3.60 of the Insolvency (England and Wales) Rules 2016 (Companies House form AM22 is acceptable). Where the move from administration to liquidation took place before 6 April 2017, or the applicant confirms that transitional provisions apply, we require a certified copy of form 2.34B (Notice of move from administration to creditors’ voluntary liquidation) prescribed by rule 2.117 of the Insolvency Rules 1986, signed by the administrator and stamped as received by the Registrar of Companies – the company enters liquidation when the form is registered by the Registrar of Companies Paragraph 83(6) of Schedule B1 to the Insolvency Rules 1986 and rule 2.117 of the Insolvency Act 1986.

2.4.1 Moving from administration to dissolution (without formal liquidation)

In addition, an administrator of a company may move a company from administration to dissolution by sending notice to the registrar of companies (paragraph 84 of Schedule B1 to the Insolvency Act 1986). Where this has happened on or after 6 April 2017 we will require evidence that complies with the requirements of rule 3.61 of the Insolvency (England and Wales) Rules 2016 (Companies House form AM23 is acceptable). Where the move from administration to dissolution took place before 6 April 2017, or the applicant confirms that transitional provisions apply, we require a certified copy of form 2.35B (Notice of move from administration to dissolution) prescribed by rule 2.118 of the Insolvency Rules 1986, signed and stamped as for form 2.34B above. In the absence of any order to the contrary, the company is deemed to be dissolved 3 months after the notice (or form) is registered by the Registrar of Companies (paragraph 84(6) of Sch.B1 to the Insolvency Act 1986).

2.5 Liquidation by order of the court

We need a certified copy of the winding up order (under section 125 of the Insolvency Act 1986) in every case. If the official receiver is the liquidator, nothing more is required. For other liquidators, you must produce one of the following as evidence:

- (before 8 December 2017) a certified copy of the resolution passed at the creditors’ meeting appointing the liquidator (under section 139(2) of the Insolvency Act 1986) (a copy of the liquidator’s appointment in Companies House form 600 is acceptable) or (on or after 8 December 2017) Companies House form 600CH

- a certified copy of the resolution passed at the contributories’ meeting appointing the liquidator and a certificate by the liquidator, or by their conveyancer, that a meeting of the contributories was duly held and that the contributories’ meeting either confirmed the appointment of the liquidator or did not pass a resolution nominating a liquidator; if the creditors’ and the contributories’ meetings nominate different liquidators, the person nominated by the creditors will act unless an order is made by the court on an application made within 7 days of the creditors’ nomination – sections 139(3) and (4) of the Insolvency Act 1986

- a certified copy of the order of the court appointing the liquidator under sections 139(4) or 140 of the Insolvency Act 1986. At any time after the presentation of a winding-up petition, the court may appoint a provisional liquidator to carry out such functions as it may confer. The powers of a provisional liquidator may be limited by the order making the appointment. A copy of form 4.15A (appointment of provisional liquidator) or form 4.31 (appointment of liquidator) is acceptable for pre-6 April 2017 appointments. For appointments on or after 6 April 2017 a copy of form WU02 (provisional liquidator) or WU04 (liquidator) is acceptable

- a certified copy of the appointment of the liquidator by the Secretary of State (under section 137 of the Insolvency Act 1986)

2.6 Registration of liquidator as proprietor of a registered estate or charge

Since the liquidator acts as agent of the company, with powers under Schedule 4 Insolvency Act 1986 that include the power to execute deeds and documents on behalf of the company, the liquidator would not normally be registered instead of the company as proprietor of a registered estate or registered charge. Any application to do so must be made using form AP1, accompanied by the evidence mentioned in Evidence of liquidation, and the appropriate fee under the current Land Registration Fee Order (see HM Land Registry; Registration Services fees) and also either:

-

a vesting order that vests the company’s property in the liquidator (in their official capacity)

-

evidence or argument to support the registration of the liquidator (as opposed to the company) as proprietor of the estate or charge (for example, a charge is being taken as security for debts, liabilities or claims due to the company, pursuant to the liquidator’s power in Schedule 4 paragraph 3 of the Insolvency Act 1986, or pursuant to powers in Schedule 4 paragraph 13); and a certificate from the liquidator (or their conveyancer) that there is no deferral of a debt or extension of credit within the meaning of the Consumer Credit Act 1974

In either case if the liquidator, rather than the company, is registered as proprietor then on any change of liquidator a transfer or assignment of the estate or charge in favour of the new liquidator, with evidence of their appointment, will need to be lodged in order to update the register.

2.7 Joint liquidators

If joint liquidators are appointed, the appointment must state whether they can act jointly and severally (section 231(2) of the Insolvency Act 1986).

3. Entry of appointment of liquidator in the register

3.1 Application required

We will only make the entries mentioned in this part of the guide if the liquidator lodges an application (under rules 184(4) and (5) of the Land Registration Rules 2003). There is no machinery for automatically making these entries when a company as proprietor of a registered estate or of a registered charge goes into liquidation.

Your application must be made using form AP1, accompanied by the evidence mentioned in Evidence of liquidation, together with the appropriate fee under the current Land Registration Fee Order; see HM Land Registry; Registration Services fees.

If you are lodging an application for registration of a company as the proprietor of a registered estate or of a registered charge, you must also supply the evidence mentioned in Evidence of liquidation. You will not need to pay any additional fees in respect of the liquidation entries. The same evidence is required when a company in liquidation applies for first registration of its title to an estate. The certificate in the first registration application form as to the absence of any petition or resolution for winding up should be amended accordingly.

3.2 Company in liquidation as proprietor of a registered estate

Depending upon the method of appointment, we will make one of the following forms of entry in the proprietorship register.

“(Date) By a Resolution dated 11 May 2005 Arthur Brown of 2 Zeus Street, Kemptville, Cornshire KV3 3PH has been appointed liquidator of XYZ Limited.”

“(Date) By an Order of the court dated 20 August 2005 Clare Dunne of 4 Apollo Court, Poseidon Street, Kemptville, Cornshire KV3 5XJ has [become] [been appointed] the liquidator of XYZ PLC.”

“(Date) By an Appointment made by the Secretary of State dated 16 April 2005 John Stitch of 6 Xerxes Buildings, Darius Road, Kemptville, Cornshire KV3 7XY was appointed liquidator of XYZ Limited.”

We will also enter the following restriction in the proprietorship register (provided these circumstances apply) if you apply for it in form RX1 and complete panel 9 with the wording set out below.

“(Date) RESTRICTION: No disposition by the proprietor of the registered estate other than a transfer on sale is to be completed by registration unless made pursuant to powers granted by the Insolvency Act 1986.”

Where the winding up is by order of the court, we will enter any restriction which may be required to reflect the provisions of such an order. Where the court has ordered the liquidator to apply, or the liquidator decides to apply, for restrictions to be entered, such an application must be made in form RX1. Where the court has ordered the registrar to enter a restriction, using its powers under section 46 of the Land Registration Act 2002, a form AP1 should be completed and submitted together with a certified copy of the court order.

You will also need to supply the appropriate fee under the current Land Registration Fee Order for the entry of the restriction if it is applied for in form RX1; see HM Land Registry: Registration Services fees. Where a restriction is required to be entered by a court order no fee is payable.

3.3 Company in liquidation as proprietor of a registered charge

Where the company in liquidation is, or is being registered as, the proprietor of a registered charge, entries similar to those mentioned in Company in liquidation as proprietor of a registered estate will be made in the charges register as follows.

“(Date) By a Resolution dated 2 February 2006 Georgina Home of 54 Jupiter Lane, Kemptville, Cornshire KV3 8NR has been appointed liquidator of XYZ Limited the proprietor of the Charge dated 25 March 1999 referred to above.”

“(Date) By an Order of the court dated 15 January 2006 Ian Jones of 94 Mercury Crescent, Kemptville, Cornshire KV3 5XJ has [become] [been appointed] the liquidator of XYZ PLC the proprietor of the Charge dated 25 March 1999 referred to above.”

“(Date) By an Appointment made by the Secretary of State dated 22 October 2004 Katharine Lewis of 6 Juno Plaza, Kemptville, Cornshire KV3 7PR was appointed liquidator of XYZ Limited the proprietor of the Charge dated 25 March 1999 referred to above.”

We will also enter the following restriction in the charges register (provided these circumstances apply) if you apply for it in form RX1 and complete panel 9 with the wording set out below.

“(Date) RESTRICTION: No disposition by the proprietor of the Charge dated 25 March 1999 in favour of XYZ Limited referred to above is to be registered other than a discharge, a transfer of charge for value or a transfer in exercise of the power of sale, unless made pursuant to the powers granted by the Insolvency Act 1986.”

Where the winding up is by order of the court, we will enter any restriction that may be required to reflect the provisions of such an order. Where the court has ordered the liquidator to apply, or the liquidator decides to apply, for restrictions to be entered, such an application must be made in form RX1. Where the court has ordered the registrar to enter a restriction, using its powers under section 46 of the Land Registration Act 2002, a form AP1 should be completed and submitted together with a certified copy of the court order.

If the entry of the restriction is applied for in form RX1, you will also need to supply the appropriate fee under the current Land Registration Fee Order; see HM Land Registry: Registration Services fees. Where a restriction is required to be entered by a court order, no fee is payable.

3.4 Restricted powers to borrow

Sometimes the resolution or the court order appointing the liquidator will reveal that they have restricted powers to borrow money on behalf of the company.

If the power of the liquidator is restricted in the resolution, and you want to have this entered in the register as a restriction, we will require a completed form RX1. You must complete panel 9 of form RX1 with the exact wording that you require.

If the power of the liquidator is restricted by the court order, we will enter any restriction that may be required to reflect the restriction on the liquidators power to borrow. Where the court has ordered the liquidator to apply, or the liquidator decides to apply, for restrictions to be entered such application must be made in form RX1. Where the court has ordered the registrar to enter a restriction, using its powers under section 46 of the Land Registration Act 2002, a form AP1 should be completed and submitted together with a certified copy of the court order.

If the entry of the restriction is applied for in form RX1, you will also need to supply the appropriate fee under the current Land Registration Fee Order; see HM Land Registry: Registration Services fees. Where a restriction is required to be entered by a court order no fee is payable.

4. Dispositions by companies in liquidation

4.1 General considerations

Anyone dealing with a company acting by its liquidator must satisfy themselves that the transaction in question is within the liquidator’s powers, even if the restrictions mentioned in Company in liquidation as proprietor of a registered estate have been entered in the register. In practice, however, in view of the wide powers contained in Schedule 4 to the Insolvency Act 1986, we are unlikely to raise any question in the case of a disposition, such as a transfer on sale, that is apparently made to realise the company’s assets. Where the liquidation has not already been noted in the register, you must supply the evidence mentioned in Evidence of liquidation with any application to register a disposition by the company acting by its liquidator.

To find out what happens to documents submitted with application forms, see Retention of documents lodged with applications.

4.2 Distributions in specie

Any surplus of assets in a members’ voluntary winding up, after all liabilities have been satisfied and costs have been paid, must be distributed by the liquidator among the members of the company according to their rights and interests therein (under section 107 of the Insolvency Act 1986). If the memorandum and articles of association so provide, this distribution may be made in specie. We require that any such transfer by a company, acting by its liquidator to a member of the company, must, when lodged for registration, be accompanied by:

- the evidence mentioned in Evidence of liquidation (if we have not already noted the liquidation in the register)

- a certified copy of the memorandum and articles of association that confer the power to distribute in specie

- a certified copy of any resolution required by the memorandum and articles of association to authorise the distribution

- evidence (for example a certified copy resolution or liquidator’s certificate) that any provisions have been complied with

- a certificate as to the value of the estate transferred

- the fee assessed on that value under the current Land Registration Fee Order; see HM Land Registry: Registration Services fees

In a creditors’ voluntary winding up the liquidator has power to make a distribution of assets in specie to creditors (sometimes also referred to as a “distribution in kind”). Once the company’s assets have been realised and there are sufficient funds, the liquidator must declare a dividend and distribute the proceeds to creditors who have (or are deemed to have proved) their debts, while retaining sufficient sums to meet liquidation expenses (rule 14.27 of the Insolvency (England and Wales) Rules 2016). Rule 14.13 also enables the liquidator – with the required permission of the creditors or the liquidation committee – to divide among the creditors and in its existing form any property which because of its peculiar nature or other special circumstances cannot readily be sold. An application to register any such transfer of an asset by a company in a creditors’ voluntary liquidation, acting by the liquidator, should be accompanied by:

- the same evidence as in the first 2 bullet points above

- confirmation that the company is in a creditors’ (as opposed to a members’) voluntary liquidation

- confirmation that the liquidator has served on the creditors the required notice of intention to declare a dividend and that any required permissions have been obtained

- a certificate as to the value of the estate transferred

- the fee assessed on the value under the current Land Registration Fee Order (see HM Land Registry: Registration Services fees)

4.3 Execution of documents

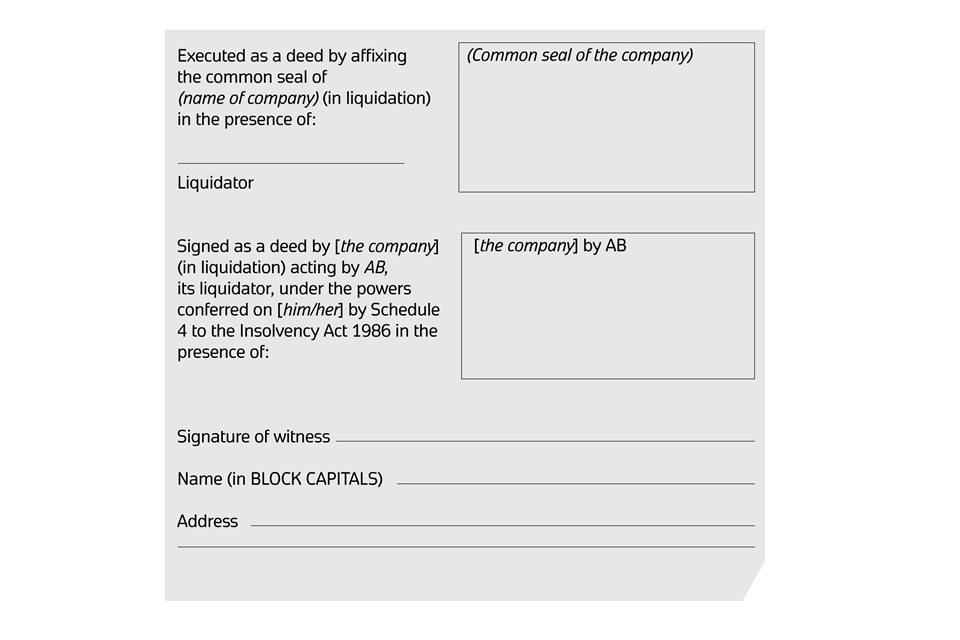

Any disposition made by a company in liquidation may be executed by the liquidator, either by affixing the company seal and signing the document to attest that the seal has been affixed in their presence (paragraph 7 of Schedule 4 of the Insolvency Act 1986 confers on a liquidator the power to use, when necessary, the company’s seal) or by signing the document as a deed in the name and on behalf of the company. Paragraph 7 of Schedule 4 to the Insolvency Act 1986 gives a liquidator power to execute all deeds and other documents in the name and on behalf of the company. A person with such a statutory power is entitled to execute a deed by signing the name of the company in the presence of at least one witness – see section 74(3) of the Law of Property Act 1925.

Examples of attestation clauses that would be acceptable are as follows.

If the liquidator is not a party to the deed, execution in their own name is not considered to be essential.

The making of a winding up order puts an end to the powers of the directors and secretary to execute documents on behalf of the company. In the case of a voluntary winding up those powers cease on the appointment of the liquidator except to the extent that they are sanctioned by either:

- in a member’s voluntary winding up, by the liquidator or the company in a general meeting (section 91(2) of the Insolvency Act 1986)

- in a creditor’s voluntary winding up, by the liquidation committee, or the creditors (if there is no such committee) (section 103 of the Insolvency Act 1986)

You must support any document executed under such powers with evidence that the requisite sanction had been given.

Where joint liquidators are appointed (whether or not the appointment is noted in the register), then:

- if they are appointed to act jointly, both/all must be named as liquidator for the company disponor in a disposition, and both/all need to execute it

- if they are appointed to act jointly and severally, then any or all of them may be named as liquidator(s) for the company disponor in a disposition, in which case the named person(s) will need to execute it

However, if joint liquidators are registered as proprietors then all of them must join in a disposition.

5. Disclaimer by the liquidator

To find out what happens to documents submitted with application forms, see Retention of documents lodged with applications.

5.1 Power to disclaim onerous property

A liquidator can disclaim onerous property by giving the prescribed notice. The liquidator may do this even though they have already taken possession of the property, tried to dispose of it or otherwise exercised rights over it (section 178(2) of the Insolvency Act 1986). The notice operates to determine the rights, interests and liabilities of the company in respect of the property. It does not, however, otherwise affect the rights or liabilities of any other person (section 178(4) of the Insolvency Act 1986).

A charge survives disclaimer by the liquidator as does the chargee’s power of sale (SCMLLA Properties Ltd v Gesso Properties [1995] BCC 793, 802-806, relying on section 104(2) of the Law of Property Act 1925). It is irrelevant whether the power arose before or after the disclaimer.

You can send a Companies House notice of disclaimer form NDISC to HM Land Registry as evidence of disclaimer.

5.2 Notifying HM Land Registry without a formal application

Under rule 19.2 of the Insolvency (England and Wales) Rules 2016, the liquidator must send HM Land Registry a copy of the notice of disclaimer of a registered estate or of a registered charge as soon as reasonably practicable after it has been authenticated (signed) and dated by the liquidator. This can be a plain copy. No formal application in form AP1 is required at this stage and no fee is payable. We will make a note in the register in the following terms.

“A notice dated [….] by the liquidator of [….] stated that the [registered estate in this title] [registered charge dated […] referred to above] was being disclaimed under section 178 of the Insolvency Act 1986.

NOTE: Copy filed.”

Although a liquidator is not required to send us a copy of a notice of disclaimer of a noted or beneficial interest, we will make a similar note if the notice relates to a noted interest. However, we will not make any entry if the notice of disclaimer relates only to a beneficial interest.

5.3 Disclaimer of leaseholds

A disclaimer of a leasehold property does not take effect until a copy of the disclaimer has been served on any underlessee or mortgagee (so far as the liquidator knows their addresses), and either:

- no application for a vesting order is made to the court within a period of 14 days from the day on which the last copy notice was served

- the court has directed that the disclaimer is to take effect (section 179 of the Insolvency Act 1986)

A liquidator who has disclaimed a registered lease may apply for formal notice of the disclaimer to be entered in the register with or without an application to close the title under rule 79 of the Land Registration Rules 2003 and/or to cancel notice of an unregistered lease in the landlord’s title.

5.3.1 Application to enter notice of disclaimer and/or to close the registered leasehold title under rule 79 of the Land Registration Rules 2003

The application must be made in form AP1 accompanied by:

- a copy of the notice of disclaimer unless there is already a notification entry in the property register as in Notifying HM Land Registry without a formal application

- the evidence of liquidation as mentioned in Evidence of liquidation

- the fee as prescribed under the current current Land Registration Fee Order; see HM Land Registry: Registration Services fees

If applying to close the registered leasehold title, you must also lodge:

- a certified copy of the original lease (or an adequate explanation of why it cannot be produced)

- evidence of devolution of title if the company is not the original lessee. We will serve notice of the application on the registered proprietor of the freehold or superior leasehold title on which the disclaimed lease is noted, on any chargee or underlessee and on any other party whose interest would be affected by closure of the title

If there is no evidence of any registered or noted charge, sub-lease or other third-party rights affecting the disclaimed leasehold title, or satisfactory evidence is supplied that every such interest has also come to an end, we will close the leasehold title and cancel any notice of the lease on the landlord’s registered title.

However, as determination of a lease by disclaimer does not affect the rights and liabilities acquired before the disclaimer by persons other than the tenant, we will not close the registered leasehold title if there is a registered or noted charge in the disclaimed leasehold title, unless the application includes:

- an application to discharge the registered charge or to cancel the entry of the noted charge

- evidence that the chargee’s application for a vesting order has been dismissed (so that the charge is excluded from all interest in the property under section 182(4) of the Insolvency Act 1986), or evidence of forfeiture of the lease

If we cannot close the registered leasehold title because there is evidence of a continuing registered or noted charge, we will make the following entries in the title for the disclaimed lease:

- in the property register:

“This lease was disclaimed by the liquidator of the registered proprietor on [date] pursuant to section 178 of the Insolvency Act 1986.

NOTE: Copy disclaimer filed.”

- in the proprietorship register:

“RESTRICTION: No disposition of the registered estate is to be completed by registration.”

We will also add the following note to the notice of the disclaimed lease in the landlord’s freehold or superior leasehold title:

“This lease was disclaimed by the liquidator of the registered proprietor on [date]. The registered leasehold title has not been closed because there is a subsisting [registered] or [noted] charge in favour of [name] dated [date].

NOTE: Copy disclaimer filed under [leasehold title number].”

The leasehold title for a disclaimed lease may be closed if there is no registered or noted charge but there is a registered sub-lease or other third-party rights noted in title, in which case the following entries will be made:

- in the property register of any noted registered sublease:

“The lessor’s title was registered but the lease was disclaimed by the liquidator of the registered proprietor on [date].

NOTE: Copy disclaimer filed under [leasehold title number].”

- and in the charges register or L Schedule of the landlord’s title:

“This lease was disclaimed by the liquidator of the registered proprietor on [date]. The registered leasehold title has been closed. There [is a] or [are] subsisting [underleasehold or details of other surviving right(s)] interest under this lease.

NOTE: Copy disclaimer filed [under title number].”

5.3.2 Application to cancel notice of an unregistered lease

The application must be lodged in form CN1 accompanied by:

- a copy of the notice of disclaimer unless there is already a notification entry in the property register as in Notifying HM Land Registry without a formal application the evidence of liquidation as mentioned in Evidence of liquidation

- a certified copy of the original lease (or an adequate explanation if it cannot be produced)

- evidence of devolution of title if the company is not the original lessee

- the fee based as prescribed under the current Land Registration Fee Order; see HM Land Registry: Registration Services fees

Where there is no evidence of any charge, sub-lease or of other third-party rights affecting the disclaimed noted lease, then the notice of the lease in the landlord’s title may be cancelled.

Where there is evidence of a continuing charge, sub-lease or other third-party rights affecting the disclaimed noted lease, the notice of the lease cannot be cancelled, but the following entries will be made:

- in the property register of any subsisting registered sub-lease granted out of the unregistered lease:

“The lessor’s lease was disclaimed by the liquidator on [date].

NOTE: Copy disclaimer filed under [freehold/superior leasehold title number].”

- and in the existing entry for the lease in the charges register or L Schedule of the landlord’s leasehold title:

“This lease was disclaimed by the liquidator on [date]. There [is a] or [are] subsisting [underleasehold or details of other surviving right(s)] interest under this lease.

NOTE: Copy disclaimer filed.”

5.4 Disclaimer of freeholds

Disclaimer of a freehold estate in land is possible, but it is less common.

If no vesting order is made by the court, the freehold estate determines and the land escheats to the Crown or to one of the Royal Duchies of Cornwall or Lancaster. However, we do not close the registered title unless and until we register either a grant from the Crown of a new freehold estate or a transfer from one of the Royal Duchies.

5.4.1 Notifying HM Land Registry without a formal application

A liquidator must send HM Land Registry a copy of the notice of disclaimer of a freehold estate, as explained in Notifying HM Land Registry without a formal application.

5.4.2 Application for formal notice of the disclaimer to be entered in the register under rules 79 and 173 of the Land Registration Rules 2003

The requirements are as stated in Application to enter notice of disclaimer and / or to close the registered leasehold title under rule 79 of the Land Registration Rules 2003.

We will make the following entry in the property register.

“The registered estate in this title has determined on disclaimer by the liquidator of the registered proprietor on [date] pursuant to section 178 of the Insolvency Act 1986.

NOTE: Copy disclaimer filed.”

If the escheated freehold title is subject to a registered lease or other inferior interest, we will also make the following entry in the property register for that title.

“The [lessor’s (or as the case may be)] registered estate has determined on disclaimer by the liquidator on [date] pursuant to section 178 of the Insolvency Act 1986 but the entries relating to the estate continue in the register.

NOTE: Copy disclaimer filed under [disclaimed freehold title number].”

We may qualify the above entries where there is some doubt as to whether escheat has taken place.

6. Vesting of registered estates on dissolution

6.1 Dissolution

A company that has been wound up voluntarily (a members’ voluntary liquidation) is deemed to be dissolved 3 months after the liquidator files the final account and return at the Companies Registry (section 201 of the Insolvency Act 1986) (unless a court order defers the date of dissolution or (where the winding up commenced after 26 June 2017) an insolvency office holder for the company appointed in another EU member state does not consent to the dissolution – section 201(2A)). If the members’ voluntary liquidation is converted into a creditors’ voluntary liquidation (under section 95 of the Insolvency Act 1986) then, again, the company is deemed to be dissolved 3 months after filing at the Companies Registry of the liquidator’s final account and return.

A company that has applied for voluntary striking off of its name from the register of companies (pursuant to sections 1003 – 1011 of the Companies Act 2006) is deemed to be dissolved 2 months after the liquidator files the final account and return at the Companies Registry where the company’s application is made on or after 10 October 2015 (section 1003(3) of the Companies Act 2006 as amended by section 103(7) of the Small Business, Enterprise and Employment Act 2015). This was previously 3 months.

Where the winding up was by the court, automatic dissolution follows 3 months after filing at the Companies Registry of the notice of the result of the final meeting by the liquidator or of a notice from the Official Receiver that the winding up is complete (section 205(2) of the Insolvency Act 1986). The Official Receiver may apply to the Registrar of Companies for early dissolution if the assets would not cover the expenses of winding up and no further investigation of the company’s affairs seems to be necessary (section 202 of the Insolvency Act 1986).

The Registrar of Companies has power to dissolve defunct companies by striking them off the register (section 1000 of the Companies Act 2006). This power applies where a company appears not to be operating and fails to respond to notices or where a company is being wound up and either no liquidator is acting or the affairs seem to have been fully wound up but the final returns have not been filed.

Where an administrator of a company moves it from administration to dissolution by filing notice at the Companies Registry, the company is normally deemed to be dissolved 3 months after the notice is registered by the Registrar of Companies.

When HM Land Registry is informed of the dissolution of a company that is proprietor of a registered estate or registered charge, we may enter notice of that fact in the register.

6.2 Property of a dissolved company

On dissolution, all the property and rights of a company (other than property held on trust for another) are deemed to be bona vacantia (section 1012 of the Companies Act 2006), and will belong to the Crown or to the Duchy of Lancaster or the Duke of Cornwall, as the case may be. If the dissolved company had its registered office in either the Duchy of Lancaster or the Duchy of Cornwall, then that Duchy takes any estate of the company wherever it is situated. Estates lying within the area of the Duchy of Cornwall vest in the Duke on dissolution, wherever the registered office of the company may have been situated. The Duchy of Cornwall is broadly the same extent as the modern county. Enquiries as to the extent of the Duchy of Lancaster, which is considerably greater than the modern county of Lancashire, may be addressed to our Fylde Office.

On an application by the Crown, the Duchy of Lancaster or the Duke of Cornwall to be registered as proprietor of land that is bona vacantia after the dissolution of a company, the evidence that we require will depend upon the way in which the company was dissolved.

6.2.1 Voluntary winding up

You must provide evidence that the liquidator filed the final account and return at the Companies Registry 3 months earlier.

6.2.2 Winding up by the court

You must provide either:

- a copy of the notice of the final meeting by the liquidator (or a copy of the notice by the Official Receiver that the winding up is complete), which was filed at the Companies Registry 3 months earlier

- evidence of the earlier dissolution if the Official Receiver has applied to the Registrar of Companies for early dissolution if the assets would not cover the expenses of winding up and no further investigation of the company’s affairs is necessary

6.2.3 Defunct company

Evidence that the Registrar of Companies has struck the company off the register.

In all cases we will require the application to be made using form AP1. A fee is required based on the value of the estate, payable under the current Land Registration Fee Order; see HM Land Registry: Registration Services fees.

The company will be cancelled from the proprietorship register and one of the following pairs of entries will be made as appropriate.

“(Date) Proprietor: THE SOLICITOR FOR THE AFFAIRS OF HIS MAJESTY’S TREASURY of 1 Ruskin Square, Croydon CR0 2WF.

(Date) The registration of the proprietor of the registered estate gives effect to section 1012 of the Companies Act 2006 and is subject to the provisions thereof.”

“(Date) Proprietor: THE SOLICITOR FOR THE AFFAIRS OF THE DUCHY OF LANCASTER of Duchy of Lancaster Office, Lancaster Place, Strand, London WC2E 7ED.

(Date) The registration of the proprietor of the registered estate gives effect to section 1012 of the Companies Act 2006 and is subject to the provisions thereof.”

“(Date) Proprietor: HIS ROYAL HIGHNESS THE PRINCE WILLIAM ARTHUR PHILIP LOUIS PRINCE OF WALES DUKE OF CORNWALL ROTHESAY AND CAMBRIDGE EARL OF CARRICK AND STRATHEARN BARON OF RENFREW BARON CARRICKFERGUS LORD OF THE ISLES PRINCE AND GREAT STEWARD OF SCOTLAND of 10 Buckingham Gate, London SW1E 6LA and of The Old Rectory, Newton St. Loe, Bath BA2 9BU in right of his Duchy of Cornwall.

(Date) The registration of the proprietor of the registered estate gives effect to section 1012 of the Companies Act 2006 and is subject to the provisions thereof.”

Where an estate that has so vested as bona vacantia is subsequently disposed of, a later order reviving the dissolved company will have no effect on the disposition. Under sections 1029-1032 of the Companies Act 2006, the court may declare the dissolution of a company (whether wound-up or struck off) void on an application made within 6 years from the dissolution. The revived company may be entitled to compensation.

7. Crown disclaimer of bona vacantia

7.1 Power to disclaim onerous property

The Treasury Solicitor and the Solicitors to the Duchies of Lancaster and Cornwall have power to disclaim property that has vested as bona vacantia as mentioned in Property of a dissolved company (section 1013 of the Companies Act 2006, or where the company was dissolved before 1 October 2009, section 656 of the Companies Act 1985). The disclaimer is effected by a notice in writing signed by the appropriate solicitor A copy of such notice may be sent to the registrar by the appropriate solicitor.

7.2 Notifying HM Land Registry of disclaimer without a formal application

Although they are not formally required to do so, the Treasury Solicitor or either of the Royal Duchies may sends us notice of disclaimer without making a formal application for closure of the relevant title or cancellation of an entry relating to the disclaimed estate or interest.

Provided the dissolved company named in the notice has the same name as the company registered as proprietor, or the solicitor confirms that they are one and the same, and there is only one proprietor, we will make an entry as follows.

In the case of notice of disclaimer of a registered lease, profit a prendre in gross or charge:

“A notice dated [………] by [The Treasury Solicitor] [The Solicitor to the [Duchy of Lancaster or Cornwall] stated that the registered estate in this title] [registered charge dated […] referred to above] was being disclaimed under section [1013 of the Companies Act 2006][656 of the Companies Act 1985].

NOTE: Copy filed.”

We will make a similar note if the notice of disclaimer relates to a noted interest. In the case of notice of disclaimer of a freehold estate in land, see Disclaimer of freehold estates in land.

No fee is payable. We will not serve notice on the company shown as registered proprietor and no entries will be made on any superior or inferior registered titles. It will be for any interested parties to make application in form AP1 accompanied by the appropriate fee for the closure of the disclaimed title, as explained in Application to close the registered title for a lease or profit a prendre in gross under rule 79 of the Land Registration Rules 2003.

7.3 Application to close the registered title for a lease or profit a prendre in gross under rule 79 of the Land Registration Rules 2003

The application must be made in form AP1 accompanied by:

- a certified copy of the notice of disclaimer by the appropriate solicitor unless there is a notification entry in the property register as in Notifying HM Land Registry of disclaimer without a formal application

- evidence that the company has been dissolved (see Property of a dissolved company

- evidence of devolution of title if the company was not the original lessee or grantee

- the fee as prescribed under the current Land Registration Fee Order; see HM Land Registry: Registration Services fees.

We will deal with the application as explained in Application to enter notice of disclaimer and/or to close a registered leasehold title under rule 79 of the Land Registration Rules 2003, with any necessary modifications to the relevant entries to refer to the relevant solicitor and statutory provision.

7.4 Application to cancel notice of an unregistered lease or profit a prendre in gross

The application must be made in form CN1 accompanied by:

- the evidence as stated in Application to close the registered title for a lease or profit a prendre in gross under rule 79 of the Land Registration Rules 2003

- a certified copy of the original lease or grant (or an adequate explanation if it cannot be produced)

- the fee as prescribed under the current Land Registration Fee Order; see HM Land Registry: Registration Services fees.

We will deal with the application as explained in Application to cancel notice of an unregistered lease.

7.5 Disclaimer of freehold estates in land

If the relevant solicitor disclaims a freehold estate in land, it determines on escheat and reverts to the Crown as demesne land or to either the Duchy of Lancaster or the Duke of Cornwall. Rule 173 of the Land Registration Rules 2003 provides that the registrar may make a note of the fact of determination of the freehold estate in the register. (It should be noted that rule 173 does not apply to freehold profits a prendre or franchises.) Where the relevant solicitor sends us a copy of a notice of disclaimer of a freehold estate in land, a note will be made in the registered title of that estate. No application is necessary and no fee is payable.

It was held in the case of SCMLLA Properties Limited v Gesso Properties (BVI) Limited [1995] BCC 793 that upon a freehold estate in land escheating to the Crown, inferior interests such as tenancies and charges held under it do not determine.

Where there appear to be inferior interests that continue notwithstanding the disclaimer, notice will be served, so far as their addresses are ascertainable from the register, on the proprietors. The entry made under rule 173 will be in the following terms.

“The registered estate in this title has determined on disclaimer by [The Treasury Solicitor][The Solicitor to the [Duchy of Lancaster][ Duke of Cornwall]] on –––––– pursuant to section [1013 of the Companies Act 2006] [656 of the Companies Act 1985].

Note: Copy disclaimer filed.”

By section 1013(2) of the Companies Act 2006 the Crown may lose the ability to disclaim bona vacantia by express waiver, taking possession or any act clearly showing the intention to do so. If application was made to register the Treasury Solicitor, Solicitor to the Duchy of Lancaster or the Duke of Cornwall as proprietor, that could amount to such a waiver. Therefore, if the vesting as bona vacantia has already been entered in the register, then the entry will be modified.

“[The Treasury Solicitor] [The Solicitor to the [Duchy of Lancaster[Duke of Cornwall]] gave notice that he disclaimed the registered estate on ––––– pursuant to section 1013 of the Companies Act 2006. The disclaimer was effective to determine the registered estate in this title only in so far as the right to disclaim had not been waived under section 1013(2) of that Act prior to that date.

Note: Copy notice filed.”

An entry will be made in the property register of any inferior registered title.

“(Date) The [lessor’s (or as the case may be)] registered estate has determined on disclaimer by [The Treasury Solicitor] [The Solicitor to the [Duchy of Lancaster or Duke of Cornwall] ]on ––––– pursuant to section [1013 of the Companies Act 2006] but the entries relating to the estate continue in the register.

Note: Copy disclaimer filed under ––––– .”

“(Date) [The Treasury Solicitor][The Solicitor to the [Duchy of Lancaster or Duke of Cornwall] gave notice that he disclaimed the [lessor’s (or as the case may be)] registered estate on ––––– pursuant to section 1013 of the Companies Act 2006. The disclaimer was effective to determine that registered estate in so far as the right to disclaim had not been waived under section 1013(2) of that Act prior to that date. The entries relating to that estate continue in the register.

Note: Copy notice filed under ––––– .”

If for any other reason there is doubt as to the efficacy of the disclaimer the registrar may make an appropriate entry in the register of the estate sought to be disclaimed and any inferior estate (rule 173(2) of the Land Registration Rules 2003). The wording of the entry will reflect the circumstances of the case.

7.6 Re-grant of a freehold estate on escheat

You should apply to register the re-grant of a freehold estate following escheat using form FR1 and form DL. The grant or transfer by the Crown or Duchy will recite details of the escheat including the title number if the determined estate is registered.

Subject to the serving of notice on the registered proprietor of the determined estate, we will register the applicant as the proprietor of the new freehold estate and the title of the determined estate will close.

The new estate will be made subject to all the incumbrances that previously affected the determined estate, unless you are able to lodge evidence that they no longer affect, for example a court order, or evidence that they are unenforceable.

7.7 Restrictions in favour of dissolved companies

7.7.1 Leasehold land

There are many leasehold developments where the registered leasehold titles to the flats or other units contain a restriction requiring the consent of a management company if a disposition by the proprietor is to be registered. It sometimes happens that such a company is struck off for failing to submit annual returns. Before dealing with the title, the registered proprietor will need to take action to ensure that the dealing may be registered. For further information where a landlord company or management company has been dissolved, see practice guide 19A: restrictions and leasehold properties.

7.7.2 Freehold land

Some freehold developments will include estate covenants in favour of a management company responsible for the maintenance of common parts such as landscape areas and access ways. Positive covenants relating to freehold land, such as to pay money for maintenance or to maintain a boundary fence, will not run with the land. A positive covenant together with a restriction in the register may be the only realistic way to ensure the management of the common parts. For circumstances in which restrictions in favour of dissolved management companies can be cancelled see 7.7.4.1 Management company dissolved – freehold land.

7.7.3 Resurrection of the management company

Often the existence of the company is fundamental to the orderly management of the development. It may be possible for an application to be made to the court under section 1024 of the Companies Act 2006, for the company to be restored to the Register of Companies. If, as is often the case, the proprietor was a member of the company they will be entitled to make the application. It may be that other lessees will be prepared to join in and share the costs since they will be faced with similar problems on their own titles.

7.7.4 Cancellation of the restriction

Where the restriction is no longer required and the proprietor can produce evidence to satisfy the registrar of this, they may apply to cancel the restriction.

This might be where the restriction was entered to protect an interest that no longer applies or to ensure compliance with obligations that have already been fulfilled. Alternatively, the proprietor may be able to show that the restriction was to protect an interest that is adequately protected by another entry in the register. The application must be made in form RX3 and be accompanied by evidence to satisfy the registrar that the restriction is no longer required (rule 97 of the Land Registration Rules 2003). If the restriction relates to an interest that vested in the Crown on dissolution of the company, the application should be accompanied by evidence of the dissolution and may require the support of the Treasury Solicitor (or the Solicitor to the Duchy of Lancaster or Cornwall).

7.7.4.1 Management company dissolved – freehold land

If evidence is provided to demonstrate that the company has been dissolved, we will be able to consider an application for cancellation. It would be useful if confirmation could be provided that the restriction relates only to the management company covenants and does not protect any other interest. Each application will, however, be considered on its merits, and requisitions raised if required.

7.7.5 Disapplication or modification of the restriction

In appropriate circumstances, the proprietor may be able to apply to the registrar for an order to disapply the effect of the restriction or to modify it (section 41(2) of the Land Registration Act 2002, rule 96 of the Land Registration Rules 2003).

The application must be made in form RX2 and must:

- state whether it is to disapply or modify the restriction (with details of any modification required)

- explain why the applicant has a sufficient interest in the restriction to make the application

- give details of the disposition or kind of disposition to be affected by the order applied for

- state why the applicant considers that the registrar should make the Order. Please note, the registrar is unlikely to consider the fact that a restriction is in favour of a company that has been struck off the Register of Companies as constituting sufficient grounds of itself for making an Order

7.7.6 Application to court

Where none of the above options are available, the proprietor may be able to apply to court for an order that the register be altered, perhaps by the cancellation of the restriction.

8. Liquidation of foreign companies

See Retention of documents lodged with applications, regarding retention of documents sent to us.

8.1 Overseas liquidation

The liquidation of a foreign company in its country of incorporation is recognised by English law. If you wish to make an application to register a disposition made by or on behalf of such a company then your application must be made in form AP1, and be accompanied by appropriate evidence of the liquidation and of its effect. This might include:

- certified copies of the court orders or other documents relied upon, and

- the written opinion of a lawyer qualified to practice company law in the country of incorporation as to the nature and effect of the proceedings on the company and as to the powers of the liquidator or other person representing the company, including the power to execute documents on behalf of the company

Certified translations should be supplied of any documents not in English or Welsh.

8.2 Liquidation in the United Kingdom

A foreign company that has been carrying on business in the United Kingdom may be wound up as an unregistered company under the Insolvency Act 1986 even though it may already have been dissolved, or otherwise ceased to exist, under the law of its country of incorporation (section 225 of the Insolvency Act 1986). The winding up will be by order of the court and we will require the evidence as mentioned in Liquidation by order of the court.

9. Things to remember

We only provide factual information and impartial advice about our procedures. Read more about the advice we give.