How we're doing: our performance so far this year

Published 20 November 2014

HMRC’s performance is measured in terms of how much revenue we collect, our levels of customer service and how well we operate within our budget. But it should also be judged on the pace of our innovation in changing the services we offer to our customers. This briefing explains how we’ve performed between April and September 2014[footnote 1].

1. The first half year: the context

We’ve had some notable successes in the first half of the year, including tax credits renewals and introducing new digital ways of working, as well as some significant challenges. We have some stretching targets to achieve another record year for collecting additional compliance revenues, while we implement some significant changes in how we serve our customers.

During the first half of the year, we rolled out, nationwide, a new tailored service for customers who need extra help and created a new online tax credits renewals service.

We also launched the biggest exercise in face-to-face staff engagement in HMRC’s history, starting an ongoing conversation about our vision for our long-term future. This will be a smaller, more highly-skilled, increasingly digital organisation based in fewer locations. In the first phase of ‘Building our Future’ more than 54,500 of our people attended almost 700 events throughout the UK, generating 50,000 pieces of feedback. We launched Phase 2 in September.

2. Bringing in the money

We brought in total tax revenues of £243.6 billion in the first half of the year; this is about £7 billion more than we brought in at the same point last year.

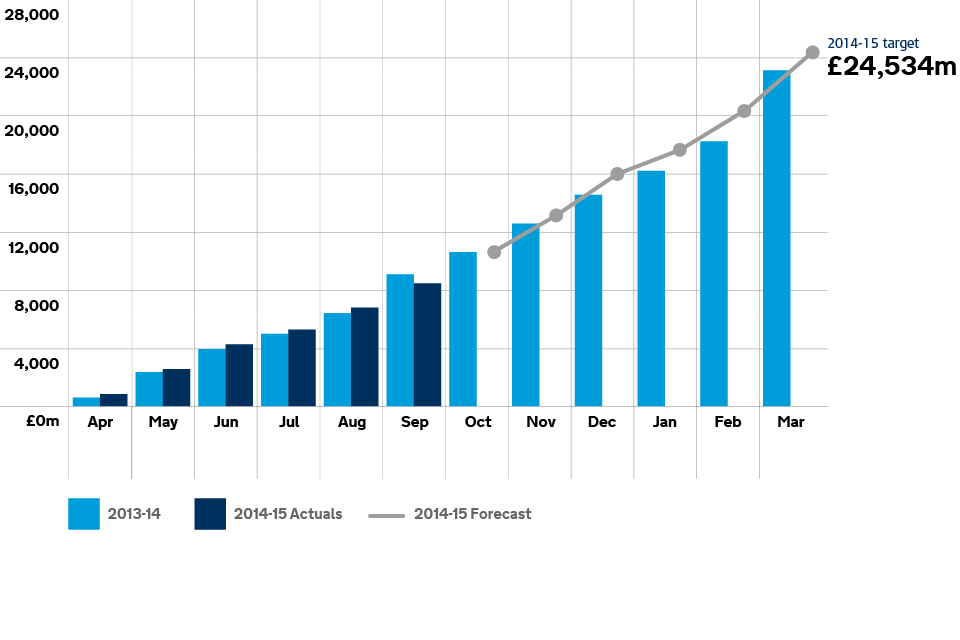

Our compliance activity secured £8.8 billion in additional revenues during the same period. We’re confident of hitting our year-end target of £24.5 billion, since the profile for our compliance revenues is generally much higher in the second half of the year than the first. We expect to secure more than £110 billion in additional compliance revenues between 2011 to 2012 and 2015 to 2016.

Our current compliance work includes introducing the accelerated payments regime, which requires users of tax avoidance schemes to pay more than £250 million in disputed tax up front. We’ve sent more than 600 notices since August and, in response, have already heard from avoidance scheme users wanting to make payments covering more than £25 million in disputed tax.

We’ve received millions of new pieces of data from organisations that process credit and debit card transactions, to help us check what businesses are claiming in revenues against what is actually being processed through cards, and by using specialist analysts we’re now matching data against taxpayer records to ensure individuals and businesses are paying what they owe.

2.1 Additional revenues brought in through compliance work

This graph shows the total revenue raised through additional tax revenue, year to date.

3. Calls to our customer helplines

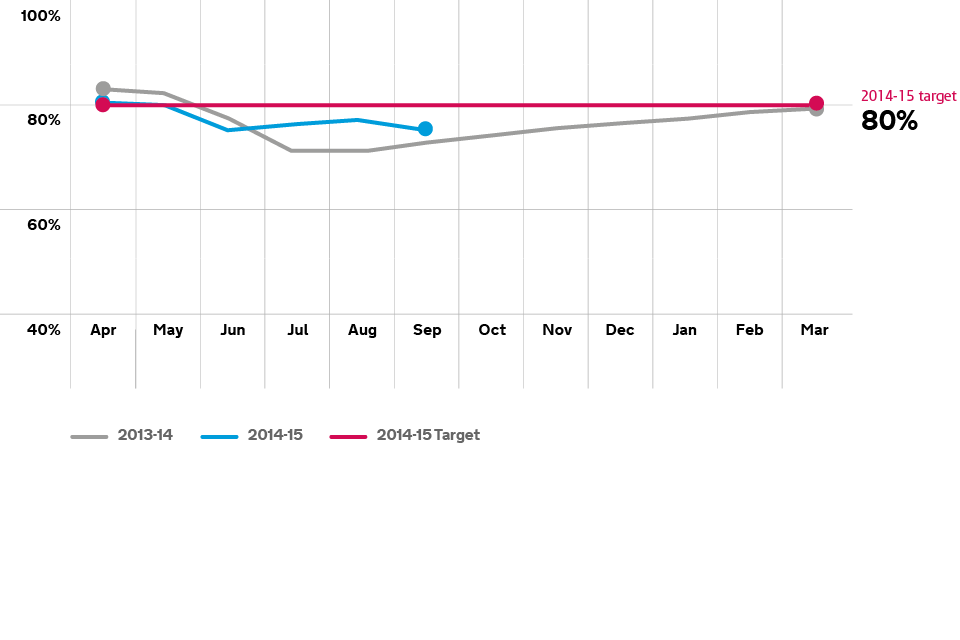

We increased the number of calls we handled to our customer helplines by 1.8% compared to the same point last year, to 74.5%. This is compared to just 48% of calls in 2010 to 2011.

Customers also benefited from better self-service options on the phone, with the introduction of voice recognition through Intelligent Telephone Automation, which drew mostly positive feedback from customers. Customers get the information they need automatically, or are routed to an adviser able to deal with their specific enquiry. So far this year our ITA service has handled 7.4 million calls.

To continue making the cost of getting in touch with us cheaper for most customers, we introduced 03 telephone numbers to our helpline services last year, which the vast majority of customers are now using. All our forms and leaflets will have been updated with 03 telephone numbers by December 2014, and we will have withdrawn all 0845 numbers.

3.1 Call attempts handled

This line graph shows the number of call attempts handled for 2013 to 2014, and 2014 to date.

4. Tax credits and child benefit claims

We improved our performance significantly throughout this year’s tax credits renewals period. This year we handled 89% of calls on July 31, compared to just 16% last year. We achieved this by, among other things, training more than 2,000 extra people from across HMRC to help answer the phones and developing an online service that 410,000 people used to renew their tax credits on PCs, tablets and smartphones, with a satisfaction rating of 94%.

We also cleared UK tax credits and child benefit claims and changes of circumstance in an average of 15 days (well within our target of 22 days) and cleared international claims and changes of circumstance in 80.3 days, well ahead of the 92-day target.

5. New digital ways of working

We are using digital technology to fundamentally change how we serve our customers. We are currently:

- testing new personalised online tax accounts for individuals and businesses, which bring all their tax and entitlements together in one place, similar to online banking

- scanning incoming post digitally, so we can move it around HMRC and deal with it faster than we can with paper post

- designing systems to create ‘golden customer records’ of all the information we hold about each customer, so we can join up what we know about our customers across all our taxes and processes for the first time

- continuing to develop our online tax credits renewals service to expand its use for tax credits renewals in 2015

- building a network of digital delivery centres to take the lead in introducing new customer online services as quickly and efficiently as possible

6. Helping UK business

We’re supporting the government’s growth initiative by helping small businesses with the tax issues that affect them. So far this year, we’ve had 650,000 interactions with small and medium-sized businesses, through webinars on topics such as starting a new business, VAT awareness and business expenses.

We’re also piloting a new online webchat service for business and a new Twitter-based help service for customers. Our existing official Twitter account already has 143,000 followers.

To help facilitate quicker and more efficient international trade, we electronically processed 28.3 million customs import declarations and 3.5 million export declarations involving UK businesses during this period. This equates to 1.5 declarations every second of every day.

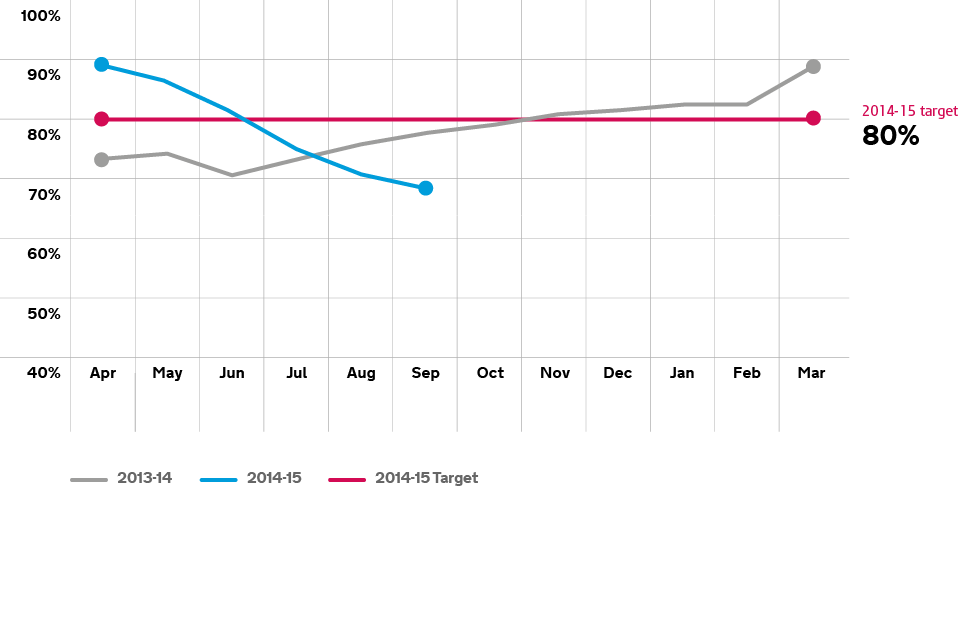

7. Post

We cleared 69% of post within 15 working days, compared to 77.3 % at the same point last year. This dropped as a result of the diversion of staff to support tax credits call handling. Volumes of post received continues to drop as we improve our call handling and seek to resolve queries ‘once and done’. We’re introducing digital post scanning so we can answer post more promptly and prevent delays caused by queries being passed between different areas of the department.

7.1 Post handled in 15 working days, year to date

This line graph shows the percentage of post handled within 15 days for 2013 to 2014, and 2014 to date.

8. More information

Find out more about our work.

-

The figures contained in this briefing are initial management information to provide an indication of our performance during 2014 to 2015, and are subject to revision and audit. Final performance figures will be made available when we publish the audited accounts and departmental report. ↩