Claim back Statutory Sick Pay paid to your employees due to coronavirus (COVID-19)

How to use the Coronavirus Statutory Sick Pay Rebate Scheme to claim back employees' coronavirus-related Statutory Sick Pay (SSP).

The Statutory Sick Pay Rebate Scheme closes for coronavirus related absences after 17 March 2022.

Employers have up to and including 24 March 2022 to:

- submit any final claims

- amend claims they’ve already submitted

Before you start

You’ll need to:

- check that you can use the Coronavirus Statutory Sick Pay Rebate Scheme

- be registered for PAYE Online

- work out your claim period

You’ll need to make sure you’ve already paid your employees’ sick pay before you claim.

Work out your claim period

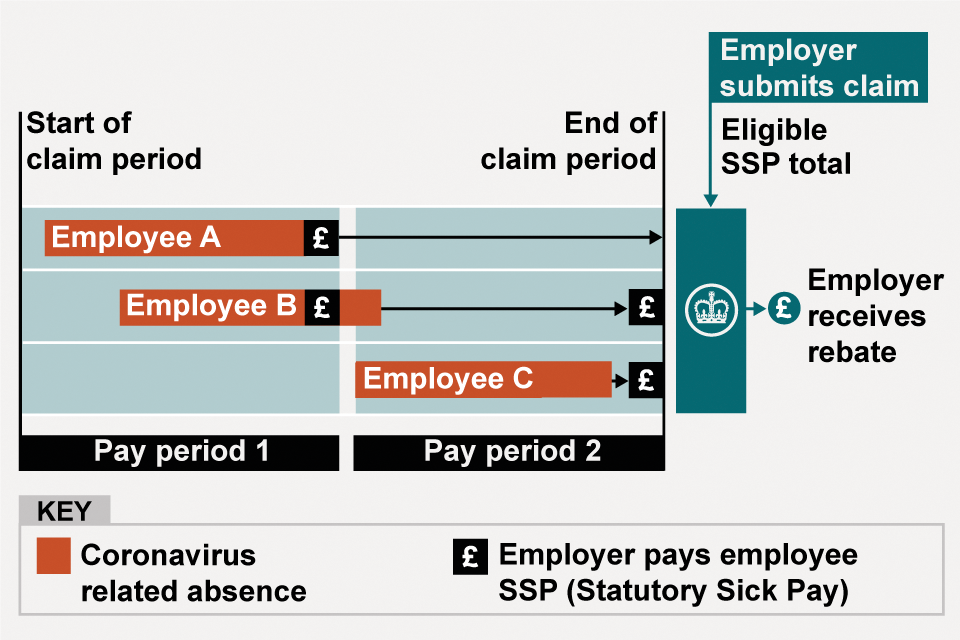

You can claim for multiple pay periods and employees at the same time. If you make multiple claims, the claim periods can overlap.

The maximum number of employees which you can claim for is the number you had across your PAYE schemes on 30 November 2021.

To complete your claim you’ll need the start and end dates of the claim period which is the:

- start date of the earliest pay period you’re claiming for ― if the pay period started before 21 December 2021 you’ll need to use 21 December 2021 as the start date

- end date of the most recent pay period you’re claiming for ― this must be on or before the date you make your claim (because you can only claim for SSP paid in arrears)

Image showing an employer claiming SSP for 3 employees over 2 pay periods. The claim starts on the first day of the first pay period, and ends on the last day of the second pay period. The claim amount is what’s paid to each employee capped at 2 weeks.

What you’ll need

You’ll need:

- the number of employees you are claiming for

- start and end dates of your claim period

- the total amount of sick pay you’re claiming back ― this should not exceed 2 weeks of the set SSP rate

- your Government Gateway user ID and password that you got when you registered for PAYE Online ― if you do not have this find out how to get your lost user ID

- your employer PAYE reference number

- the contact name and phone number of someone we can contact if we have queries

- your UK bank or building society account details (only provide account details where a Bacs payment can be accepted) including:

- bank or building society account number (and roll number if it has one)

- sort code

- name on the account

- your address linked to your bank or building society account

Records you must keep

You must keep records of Statutory Sick Pay that you’ve paid and want to claim back from HMRC.

You must keep the following records for 3 years after the date you receive the payment for your claim:

- the dates the employee was off sick

- which of those dates were qualifying days

- the reason they said they were off work ― if they had symptoms, someone they lived with had symptoms or they were shielding

- the employee’s National Insurance number

You can choose how you keep records of your employees’ sickness absence. HMRC may need to see these records if there’s a dispute over payment of SSP.

You’ll need to print or save your state aid declaration (from your claim summary) and keep this until 31 December 2024.

How to claim

The Coronavirus Statutory Sick Pay Rebate Scheme has now closed. The last date for submitting or amending a claim was 24 March 2022.

If you use an agent

If you use an agent who is authorised to do PAYE Online for you, they will be able to claim on your behalf. You should speak to your agent about whether they are providing this service.

If you cannot claim online

Employers who are unable to claim online should have received a letter on an alternative way to claim. Contact HMRC if you have not received a letter and are unable to make any eligible claims online.

After you’ve claimed

Your claim will be checked, and if valid, paid into the account you supplied within 6 working days.

HMRC will check claims and take appropriate action to withhold or recover payments found to be dishonest or inaccurate. Where employers knowingly and deliberately provide false or misleading information to benefit from the claim, HMRC will apply penalties of up to £3000.

We will contact you using the details you provided if we have any queries about the claim.

You cannot check the progress of your claim. Do not contact HMRC unless it has been more than 10 working days since you have made your claim and you have not received it or been contacted by us within that time.

Other help you can get

Get help online

Use HMRC’s digital assistant to find more information about the coronavirus support schemes.

Contacting HMRC

We are receiving very high numbers of calls. Contacting HMRC unnecessarily puts our essential public services at risk during these challenging times.

You can contact HMRC about the Coronavirus Statutory Sick Pay Rebate Scheme if you cannot get the help you need online.

Updates to this page

Published 26 May 2020Last updated 1 April 2022 + show all updates

-

The Coronavirus Statutory Sick Pay Rebate Scheme has now closed. The last date for submitting or amending a claim was 24 March 2022.

-

Added translation

-

Added information on the Statutory Sick Pay Rebate Scheme for coronavirus related absences because the scheme closes after 17 March 2022.

-

The scheme has been reintroduced. You can only claim for employees who were off work on or after 21 December 2021. The maximum number of employees you can claim for is the number you had across your PAYE schemes on 30 November 2021. If the period of absence started before 21 December 2021, you’ll need to use 21 December 2021 as the start date.

-

This scheme will be reintroduced from mid-January 2022. Further guidance will be available as soon as possible.

-

Welsh translation added to the page.

-

First published.