Cyber security sectoral analysis 2022

Updated 18 February 2022

Ministerial foreword

Over the last decade, we have established the UK as a cyber power, through building cutting-edge cyber security capabilities, and significant growth in our cyber security sector. In December 2021, the government published the National Cyber Strategy, which sets out how we will ensure that the UK in 2030 continues as a leading responsible and democratic cyber power, able to protect and promote our interests in and through cyberspace.

The strategy sets out our commitment to ‘strengthening the UK cyber ecosystem, investing in our people and skills and deepening the partnership between government, academia and industry.’ To achieve this, we must continue to foster the growth of a sustainable, innovative, and internationally competitive cyber security sector, delivering quality products and services, which meet the needs of government and the wider economy.

This Cyber Security Sectoral Analysis research has tracked the growth of the UK cyber security sector since 2018 and highlights the impressive performance of many of our firms, and their steadfast resilience in recent years.

Within this year’s study, we are now tracking over 1,800 cyber security firms in the UK. In the last 12 months, the sector has demonstrated double-digit growth across a number of key measures. The sector’s revenue has grown to more than £10 billion for the first time, and the sector has added over 6,000 jobs. 2021 was also a record year for external investment into the sector – with over £1 billion raised by firms across the UK.

However, we know that work must continue to ensure the UK remains resilient and prosperous, and that this is shared across all parts of the country as part of the Levelling Up agenda. We have therefore continued to support investment, skills, and collaboration across the cyber security ecosystem.

This includes supporting innovators to grow and scale through the NCSC (National Cyber Security Centre) for Startups, LORCA (London Office for Rapid Cybersecurity Advancement), and Cyber Runway programmes. We are working to narrow the skills shortfall in cyber security, through the Cyber Explorers youth programme, the CyberFirst bursary scheme, new apprenticeship standards, skills bootcamps, and professionalising the cyber security workforce, with work being led by the new UK Cyber Security Council.

Ensuring collaboration across the regions is also critical to the success of the UK’s cyber security ecosystem, and the UK Cyber Cluster Collaboration (UKC3) is building new partnerships between industry, schools and colleges right across the country.

The growth of the cyber security sector continues to be one of the UK’s tech success stories. I would like to thank everyone working in cyber security for their contribution over the past year, and we will continue to do all we can to help make the UK the safest place to live and work online.

Julia Lopez MP

Minister of State for Media, Data, and Digital Infrastructure

Executive summary

Introduction

Ipsos, Perspective Economics, glass.ai and the Centre for Secure Information Technologies (CSIT) at Queen’s University Belfast were jointly commissioned by the Department for Digital, Culture, Media and Sport (DCMS) in February 2021 to undertake an updated analysis of the UK’s cyber security sector.

This analysis builds upon the previous UK Cyber Security Sectoral Analysis (published in February 2021) that provides a recent estimate of the size and scale of the UK’s cyber security industry. This provided an assessment of:

- The number of businesses in the UK supplying cyber security products or services

- The sector’s contribution to the UK economy (measured through revenue and Gross Value Added, or GVA)

- The number employed in the cyber security sector

- The products and services offered by these firms

Project scope and summary of methodology

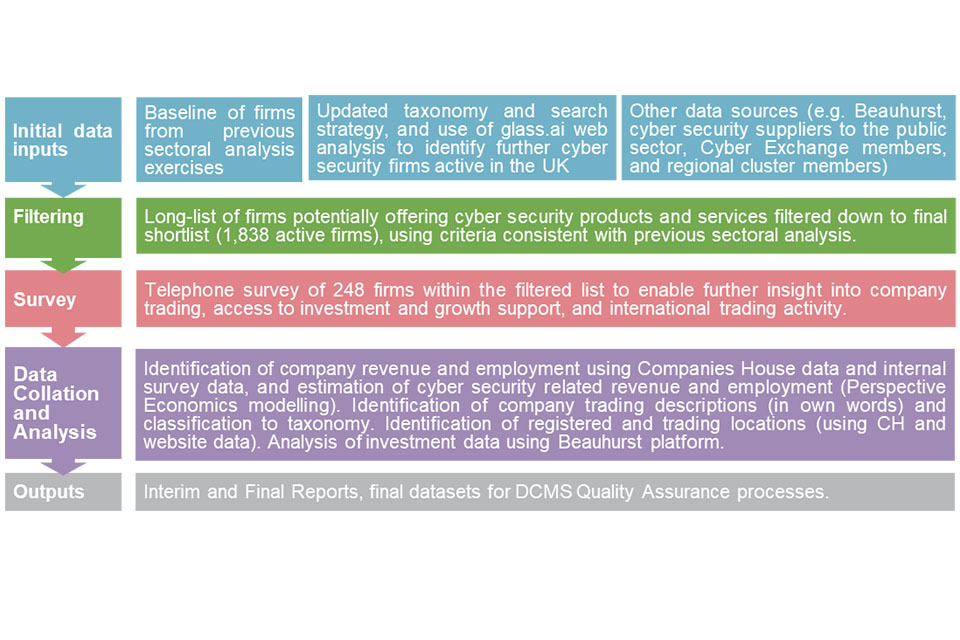

The diagram below sets out a summary of the research methodology used. This is consistent with previous studies to support a time-series analysis of the sector’s performance to date.

This is a visual flow chart summary of the methodology for this study, which is also covered in section 1.1 of the report in writing

Source: Ipsos, Perspective Economics, and the Centre for Secure Information Technologies

Key findings

Number of companies

- We estimate that there are 1,838 firms active within the UK providing cyber security products and services

Sectoral employment

- We estimate there are approximately 52,700 Full Time Equivalents (FTEs) working in a cyber security related role across the cyber security firms identified

- This reflects an estimated increase of 6,000 cyber security employee jobs within the last 12 months (an increase of 13%)

Sectoral revenue

- We estimate that total annual revenue within the sector has reached £10.1 billion within the most recent financial year

- This reflects an increase of 14% since last year’s study (and is twice the growth rate experienced in the previous year’s study, suggesting that 2021 was a positive year for the industry)

Gross Value Added

- We estimate that total GVA for the sector has reached c. £5.3 billion

- This means total GVA has increased by a third in the past year (the largest increase to date seen within the sectoral analysis project series)

- We estimate that GVA per employee has increased from £85,700 to £101,000 within the last year (an increase of 17%), suggesting improved productivity reflected through company profitability and staff remuneration. This is now higher than the current estimated GVA per employee for the DCMS Digital Sector (DCMS Economic Estimates) of £95,000 per employee

Investment

- 2021 was a record year for cyber security investment raised in the UK. We have identified over £1 billion raised by dedicated cyber security firms in the last 12 months, across 84 deals

1. Introduction

This analysis builds upon the previous UK Cyber Security Sectoral Analysis (published in February 2021) that provides a recent estimate of the size and scale of the UK’s cyber security industry.

This provided an assessment of the number of businesses in the UK supplying cyber security products or services; the sector’s contribution to the UK economy (measured through revenue and Gross Value Added, or GVA); the number employed in the cyber security sector; and an overview of the products and services offered by these firms.

The Cyber Security Sectoral Analysis project has helped to track the growth and performance of the UK’s cyber security sector since 2018. In December 2021, the Government published the National Cyber Strategy 2022, which commits to strengthening the structures, partnerships, and networks necessary to support a whole-of-society approach to cyber, and fostering the growth of a sustainable, innovative, and internationally competitive cyber and information security sector, delivering quality products and services. This analysis therefore provides an evidence base to track the health of the cyber security industry on an annual basis.

1.1 Methodology and sources

The UK cyber security sector does not have a formal Standard Industrial Classification (SIC) code, and this study therefore closely aligns itself to that of the baseline analysis, to provide a time series analysis of how the sector has progressed since the baseline (2017) and subsequent annual studies.

The cyber security sector remains fast-moving, and continually subject to changes in products, services, and market approaches. For this year’s study, we have therefore further refined the methodology to ensure improved identification of businesses offering cyber security products and services in the UK. This includes:

- An updated and refined taxonomy to better identify and classify cyber security activity

- A new partnership with leading data intelligence firm glass.ai (using Artificial Intelligence, or AI, techniques to identify businesses using web data)[footnote 1]

- Updated telephone and online survey of cyber security businesses

The following methodology and research sources were used to provide an overarching shortlist of UK cyber security businesses, and to estimate their economic contribution related to the sale of cyber security products or services.

The process by which we identify and measure the economic contribution of cyber security activity reflects a best estimate by the Ipsos, Perspective Economics, glass.ai and Centre for Secure Information Technologies team, using agreed parameters for the inclusion of respective firms considered to be active in the field.

The key stages below are consistent with previous Cyber Security Sectoral Analysis exercises to enable a time series comparison.

Stage 1: Desk research

The research team conducted initial desk research to explore how the cyber security market had changed within the last 12 months. This included:

- Engagement with UK cyber security regional networks and clusters, to gather local intelligence

- A review of published reports regarding the output or activities of the sector (e.g. UK Cyber Security Exports Strategy and associated annual export statistics)

- Recent investments or initiatives in the cyber security sector (including review of investments and acquisitions, and identification of new industry initiatives and cohorts, e.g. Cyber Runway)

- Any emerging trends in the market (including supply side and demand side), e.g. enhanced demand attributable to cloud security or working from home, or new product innovations requiring specific cyber security requirements

Stage 2: Initial data collection & gap analysis

The research team sought to identify potential active cyber security firms in the UK through:

- A review of firms previously identified in the sectoral analysis (identifying current status and determining inclusion in the updated set)

- A review of company participation within clusters, networks, and/or government supported initiatives

- A revised search strategy and updated taxonomy, informed through workshops with industry and academic stakeholders in the cyber security community

- An updated taxonomy has been used to inform a long list of firms (identified through use of glass.ai web data and by Perspective Economics). This list was subject to automated and manual review, and refined to a final cyber security business list for analysis (n = 1,838)

The business metrics include (but are not limited to):

- Company name, registered number, company status, and date of incorporation

- Registered and trading locations (using official and web data)

- Company website and contact details

- Core description of company activities related to cyber security

- Company size (large / medium / small / micro)[footnote 2]

Stage 3: Cyber Security Sectoral Survey

Ipsos conducted a representative survey of 248 cyber security firms from May to July 2021. The survey used the list of firms established in Stage 2 of this study as a sample frame. The purpose of the survey was to understand firm-level performance, barriers, and collaboration in further detail.

It covered the following topics:

- The categories of products and services offered across firms

- The client sectors that cyber security firms work across

- Revenue estimates (to supplement the other published data found in Stage 2)

- Extent of export activity, or international collaboration

- Perceived barriers to growth

- Understanding areas of collaboration and reasons for working with cyber security partners

Appendix C provides the full technical details for the survey, including the data collection approaches and response rate.

Stage 4: Qualitative consultations

This research has also been supported through 25 one-to-one consultations with cyber security firms, buyers of cyber security products and services, and investors in the cyber security sector. Participants were purposively sampled to reflect variation in size, location, product or service focus, and maturity, with participating cyber security firms being recruited from the Ipsos survey recontact sample. Larger cyber buyers were purposively sampled to capture feedback on how demand was evolving to address new challenges.

Stage 5: Data blending

In August 2021, the results of the cyber security sector survey were used to inform gaps within the list of identified cyber security sector firms e.g. the extent to which a firm provided cyber security products or services and attributed revenues accordingly. This stage involved data cleaning and joining to provide a final dataset of cyber security firms, including the development of firm-level metrics used for analysis within the report.

Stage 6: Data analysis and reporting

The final stage involved analysis of the final shortlist of firms to provide estimates of total number of firms, products and services offered, whether firms are ‘dedicated or diversified’ with respect to how much of their activity related to cyber security provision, revenue/GVA/employment estimates, locations (registered, trading, and international presence), investment and survey feedback (anonymised at an individual level).

The data sources used to underpin the sectoral analysis included:

- glass.ai: this year’s study has partnered with web-scale intelligence providers glass.ai to use web data to help identify and map new providers of cyber security products and services, and match these to the cyber security taxonomy

- Bureau van Dijk FAME (and Companies House Data Product): This platform collates Companies House data and financial statements from all registered businesses within the UK

- Beauhurst: Beauhurst is a leading investment analysis platform, which enables users to discover, track and understand some of the UK’s high-growth companies e.g. identify investment, accelerator participation, and key information

- Tussell: Tussell provides market insight into public sector procurement through identifying key contracts, spend, buyers and suppliers

- Cyber Exchange: techUK’s Cyber Exchange directory enables cyber security providers to register an account and set out the products and services they provide to the market

- Web scraping: our team (glass.ai and Perspective Economics) has used web scraping to extract and parse key company descriptions, locations, and contact details from identified company websites[footnote 3]

- Representative survey of cyber security firms: in Summer 2021, Ipsos conducted a representative survey of cyber security firms. The feedback from 248 providers has been useful to understand the financial performance, growth drivers, and challenges for firms within the market

- One-to-one qualitative consultations: further, the team has also conducted 25 one-to-one consultations with investors and market providers, to gather feedback on the growth and performance of the cyber security sector in the UK

1.2 Consistency with the 2021 Cyber Security Sectoral Analysis

Our approach remains consistent with previous reports (and builds upon the methodology to identify and measure the contribution of the sector). As per previous studies, this report also explores firms that:

- Have a clear presence within the UK market, through a UK registered business that reports to Companies House on an annual basis

- Demonstrate an active provision of commercial activity related to cyber security (e.g. through the presence of a website / social media)

- Provide cyber security products or services to the market (i.e. sell or enable the selling of cyber solutions to other customers)

- Have identifiable revenue or employment within the UK

- Appear to be active at the time of writing (i.e. have not, or are not in the process of dissolution)

- Are not charities, universities, networks, or individual contractors (non-registered) – all excluded for analysis purposes

It also draws upon consistent sources, i.e. company accounts, longitudinal survey data, and Beauhurst for investment data. The financial analysis of firms is also consistent, as it uses company information from the most recent financial year of accounts (analysis undertaken in late 2021, with financial year 2020/21 as the modal year for published accounts) and the underpinning dataset sets out where employment, revenue, GVA and investment are either known or estimated (and the rationale underpinning this).

The identification of firms related to the industry has been improved through the partnership with glass.ai, and subject to manual review to identify a full list of firms included in the UK cyber security sectoral database. The inclusion of glass.ai (and enhanced engagement with third parties) has helped to identify more businesses at an early/micro stage, and those diversified firms with a cyber security presence. This has helped to boost the number of active firms from 1,483 to 1,838.

However, this also demonstrates that previous studies have captured the most prevalent providers of cyber security products and services - as the firms identified last year cover 94% of the revenue, 93% of the GVA, and 94% of the employment identified within this year’s study.

1.3 Interpretation of the data

Across this report, percentages from the quantitative data may not add to 100%. This is because:

- We have rounded percentage results to the nearest whole number

- At certain questions, survey respondents could give multiple answers

It is also important to note that the survey data is based on a sample of cyber sector firms rather than the entire population. Therefore, they are subject to sampling tolerances. The overall margin of error for the sample of 248 firms (within a population of 1,838 firms) is between c.3 and c.6 percentage points. The lower end of this range (3 percentage points) is used for survey estimates closer to 10% or 90%. The higher end (6 percentage points) is used for survey estimates around 50%. For example, for a survey result of 50%, the true value, if we had surveyed the whole population, is extremely likely to be in the range of 44% to 56%.[footnote 4]

By contrast, the data from the 25 qualitative consultations is intended to be illustrative of the key themes affecting the cyber security sector, as a whole, rather than a statistically representative view of cyber sector businesses or investors.

1.4 Acknowledgements

The authors would like to thank the DCMS team for their support across the study. DCMS and the report authors would also like to thank those that participated within this research, including those that participated within the industry survey, the regional cyber security clusters, consultations, and shared data, knowledge, and feedback to help underpin this study.

Note: The cyber security sector continues to increase in size, scope, and specialisms. We are happy to receive comments and feedback regarding the methodology or findings herein, through contacting cybersecurity@dcms.gov.uk

2. Profile of the UK cyber security sector

2.1 Defining the UK cyber security sector

Within the National Cyber Security Strategy 2022, cyber security is defined as:

The protection of internet connected systems (to include hardware, software, and associated infrastructure), the data on them, and the services they provide, from unauthorised access, harm, or misuse. This includes harm caused intentionally by the operator of the system, or accidentally, as a result of failing to follow security procedures or being manipulated into doing so.

Therefore, this sectoral analysis seeks to identify businesses active within the UK that provide products or services that enable the protection of internet connected systems and their users.

In line with previous studies, this analysis is focused upon organisations that include all of the following attributes:

- Have a clear presence within the UK market, through a UK registered business that reports to Companies House on an annual basis

- Demonstrate an active provision of commercial activity (e.g. through the presence of an active website / social media presence)

- Provide cyber security products or services to the market (i.e. sell or enable the selling of cyber solutions to other customers) – aligned to the taxonomy set out below

- Have identifiable revenue or employment within the UK related to cyber security

- Appear to be active at the time of writing (i.e. have not, or are not in the process of dissolution)

- Are not charities, universities, networks, and individual contractors (non-registered) – which are all excluded for analysis purposes

The businesses included within this analysis are considered to provide one or more of the following products or services:

- Cyber professional services, i.e. providing trusted contractors or consultants to advise on, or implement, products, solutions, or services for others.

- Endpoint and mobile security, i.e. hardware or software that protects devices when accessing networks

- Identification, authentication, and access controls, i.e. products or services that control user access, for example with passwords, biometrics, or multi-factor authentication

- Incident response and management, i.e. helping other organisations react, respond, or recover from cyber attacks

- Information risk assessment and management, i.e. products or services that support other organisations to manage cyber risks, for example around security compliance or data leakage

- Internet of Things (IoT Security), i.e. products or services to embed or retrofit security for Internet of Things devices or networks

- Network security, i.e. hardware or software designed to protect the usability and integrity of a network

- SCADA and Information Control Systems, i.e. cyber security specifically for industrial control systems, critical national infrastructure, and operational technologies

- Threat intelligence, monitoring, detection, and analysis, i.e. monitoring or detection of varying forms of threats to networks and systems

- Awareness, training, and education, i.e. products or services in relation to cyber awareness, training, or education

Section 2.3 sets out the type of cyber security products and services in further detail.

2.2 Number of cyber security firms active in the UK

We estimate that there are currently 1,838 firms active within the UK providing cyber security products and services. This reflects a glass.ai and Perspective Economics estimate as of Autumn 2021.

Whilst this reflects an increase in the number of firms offering cyber security products and services (1,483 identified in the previous study), the research team emphasise that this is one metric among many to gauge the health of the sector. For example, this increase includes:

- Newly registered companies offering cyber security products and services (often very early / small start-ups)

- Previously registered companies that did not previously offer such services, but have established a product or team to do so recently (e.g. consultancies offering IT risk services)

- Businesses now identified as providing a relevant cyber security product or service (e.g. identified through provision of an accredited scheme such as Cyber Essentials) where previous web-data matching did not flag such products or services.

- Businesses with limited web data reporting the provision of cyber security products or services, but which have been flagged through engagement with other sources (e.g. consultation with regional clusters).

Throughout this study, the report authors stress the need to draw upon a wide range of existing sources, alongside the development and deployment of a cyber security taxonomy against Companies House data, analysis of relevant website domains, and in-depth regional engagement.

Within the process, a ‘long list’ of several thousand businesses in the UK was identified as potentially relevant to the cyber security sector using keywords and web data. However, this long list was subsequently filtered to ensure each business demonstrated sufficient alignment to the research parameters and the market taxonomy.

For example, web data can identify firms that may have an active registration with Companies House, have a website or social media presence, and meets the parameters of the taxonomy. However, further review of the presence may indicate a lagging status (e.g. the business may have no true employees or may not appear to be active for several years). The team therefore reviewed more than 3,000 firms in detail, removing organisations that may have mentioned security (e.g. offering a secure data centre service) but did not appear to tangibly offer cyber security products or services to the end-market.

This yielded the 1,838 firms in scope, and the research team considers this to be an appropriate figure to gauge the health and composition of the sector whilst ensuring consistency with previous analysis.

We do however note, that as with all emerging sectors, subtle differences in definition can result in varying interpretations of the size and composition of activity. In this respect, there may be other relevant cyber security use cases, which could in future meet the short list requirements (i.e. the 6 conditions set at the beginning of Section 2.1) and could therefore be included in future analysis. This might include, for example, firms involved in areas such as FinTech, RegTech or SafetyTech. However, we provide these parameters to avoid duplication, and provide DCMS with a health check regarding the overall cyber security market.

There are also businesses operating within the UK that may, for example, resell cyber security solutions (anti-virus, anti-malware, spam filtering etc) through a broader package of managed IT support. As this cyber security spend should be reflected in the revenues of those providing rather than reselling these solutions, we place less focus on the role of resellers within the sectoral analysis (although do include a small number of larger resellers that offer cyber security advisory services and implementation support).

Overall, this process means that the 1,838 firms for analysis within this report have been assessed and verified as providers of cyber security products and solutions. We provide a high-level breakdown of this provision in subsequent chapters. Given the breadth of ‘cyber security’ as a term, we endeavour to be clear regarding what is in scope, what is being measured, and why this matters, for the sector and for the wider economy and society.

The following sub-sections set out an overview of the number of companies by size; the breakdown between companies that appear dedicated or diversified; and the products and or services provided by each company.

Number of registered firms by size

For the 1,838 cyber security firms identified, Figure 2.1 and Table 2.1 demonstrate the breakdown by size. [footnote 5]

Figure 2.1: Number of registered cyber security firms by size

| Size | Percentage |

|---|---|

| Large | 8% |

| Medium | 10% |

| Small | 24% |

| Micro | 57% |

Source: Perspective Economics, glass.ai (n = 1,838)

Within the UK, the vast majority of all businesses are Small and Medium Enterprises (SMEs), and it is therefore to be expected that the majority of registered businesses within the cyber security sector are small (24%) or micro (57%) in size.

As this study focuses upon businesses with at least one member of staff, the following comparison is noted between the UK’s cyber security sector, and the broader UK business population. This highlights that, despite the cyber security sector containing a considerable proportion of micro and small businesses, there are many providers of scale operating within the UK market (i.e. 18% of businesses offering cyber security products and services to market are medium or large, compared to 4% of all businesses in the UK).

Table 2.1: Comparison of the size of cyber security firms and wider business population

| Size | UK Business Population Estimates (2021) | Percentage | Cyber Security Sectoral Analysis | Percentage |

|---|---|---|---|---|

| Large (250+ employees) | 7,655 | 1% | 156 | 8%[footnote 6] |

| Medium (50-249) | 35,620 | 3% | 184 | 10%[footnote 6] |

| Small (10-49) | 210,550 | 15% | 447 | 24%[footnote 6] |

| Micro (1-9) | 1,162,155 | 82% | 1,051 | 57%[footnote 6] |

| All Businesses with at least 1 employee | 1,415,980 | 100% | 1,838 | 100%[footnote 6] |

Change in size

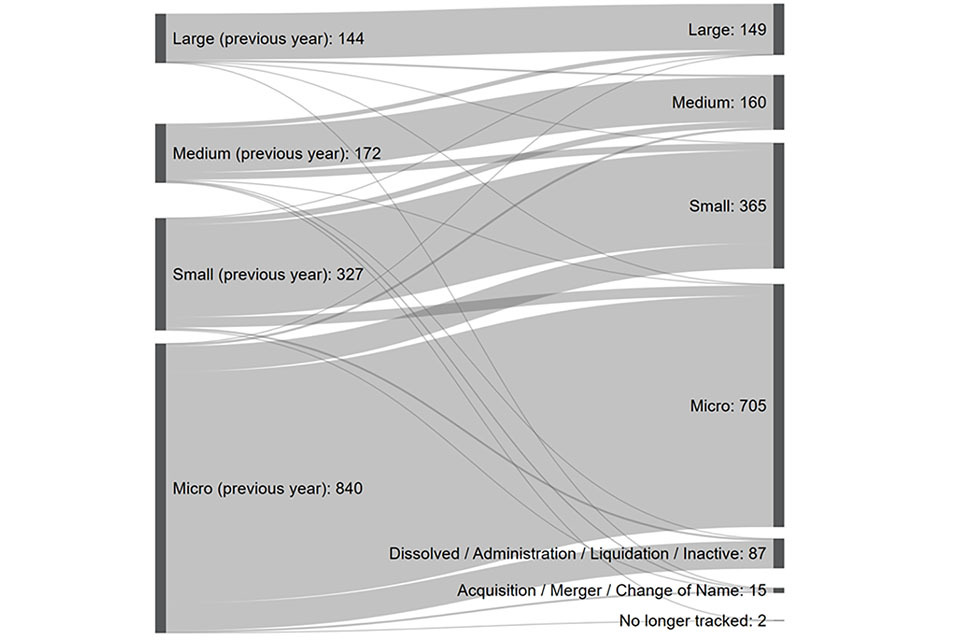

Following last year’s sectoral analysis, we have tracked the performance of each firm (n = 1,483 in the previous study) to understand how the size of cyber security firms has changed (where applicable) in the last 12 months.

The left side of the Sankey diagram (Figure 2.2) shows the size of cyber security firms as identified in the 2021 study, with the right side showing their updated size currently. As this is a brief time period, the size composition of firms remains fairly static.

However, this does highlight that 5.9% of firms appear to have closed or are no longer fully trading within the last 12 months.[footnote 7]

This is a higher closure rate than identified within the previous study (4.6%), potentially reflecting a challenging couple of years for many micro firms, or the potential for market acquisitions and mergers.

Figure 2.2: Sankey flow chart – size (2020 – 2021)

Sankey flow chart showing the size composition of cyber security firms between 2020 and 2021. The size composition of firms remains fairly static overall.

Source: Perspective Economics (n = 1,483)

Dedicated and diversified providers of cyber security products and services

Within this research, we attempt to categorise firms by whether they are either:

- Dedicated, i.e. most (>75%) of the business’ revenue or employment can be attributed to the provision of cyber security products or services

- Diversified, i.e. less than 75% of the business’ revenue or employment can be attributed to the provision of cyber security products or services

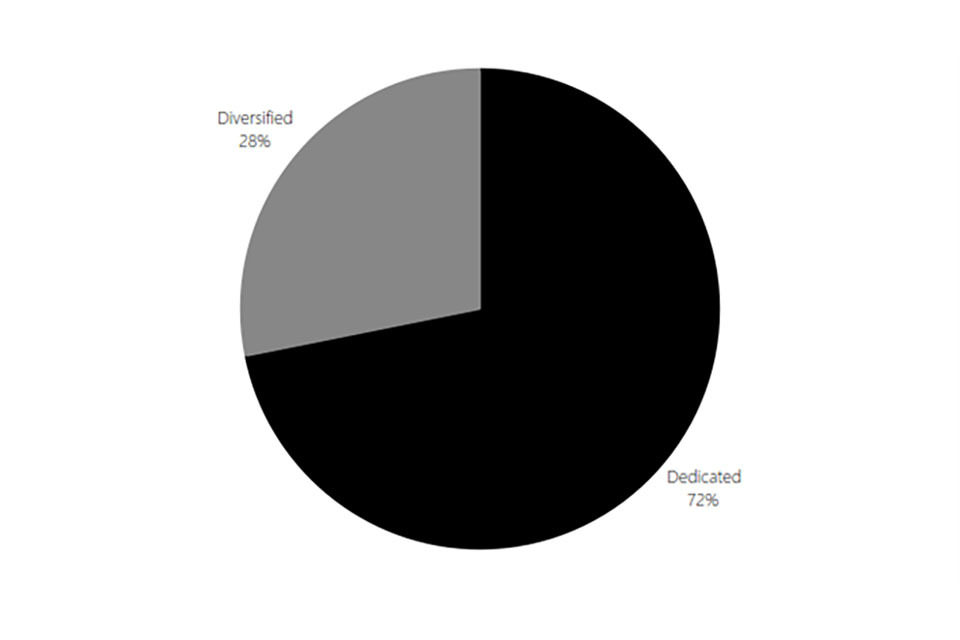

Figure 2.3: Dedicated and diversified providers

Pie chart showing the proportion of dedicated versus diversified providers of cyber security products and services. 72% are dedicated while 28% are diversified.

Source: Perspective Economics (n = 1,838)

The rationale underpinning the need to provide this distinction is attributable to seeking to understand how firms either set up to solely provide cyber security, or firms that provide cyber security as one product or service among others vary with respect to size, scale, growth, and market activity.

Within the current dataset, almost three-quarters (72%) of firms are dedicated providers of cyber security products and services. This reflects no change from the previous study.

Disaggregating these firms by size (as below in Figure 2.4) also highlights that micro and small firms within this analysis are much more likely to be dedicated (86% and 66% respectively), whereas there are few large dedicated cyber security firms (18%).

In other words, this reflects the tendency for several large and medium sized companies in the UK to establish cyber security practices to complement existing provision, e.g. management consultancies, managed service providers, or telecoms firms developing a cyber security division that sells to the market.

Figure 2.4: Dedicated / diversified cyber security firms by size

| Businesses | Dedicated | Diversified |

|---|---|---|

| Large | 18% | 82% |

| Medium | 48% | 52% |

| Small | 66% | 34% |

| Micro | 86% | 14% |

Source: Perspective Economics (n = 1,838)

Products and services provided by the UK cyber security sector

In order to understand the products and services provided by the UK cyber security sector, DCMS and the research team use a taxonomy (as summarised below) to categorise each of the products and services offered. This provides a high-level overview of the UK’s cyber security product and service offer.

This taxonomy remains broadly consistent with previous years; however, the underlying keywords and terms have been revisited and updated. Further, the use of web data and manual review means that firms can be classified into taxonomy areas through both the text available, and the analyst decision regarding key products and services. This means that the following data reflects an interpretation of the key products and services offered. It is therefore indicative of the main solutions provided by the UK cyber security sector.

In previous studies, the cyber security business survey had asked respondents which products and services they provide (against the taxonomy areas); however, this found that many respondents report to offer all or most of these products and services, which made delineation between specialisms difficult to measure. Therefore, we take a top-down review of products and services using the text data available through web data review.

Taxonomy definitions:

| Taxonomy Category | Definition (Short) |

|---|---|

| Cyber professional services | Providing trusted contractors or consultants to advise on, or implement, cyber security products, solutions, or services for others |

| Endpoint and mobile security | Hardware or software that protects devices when accessing networks |

| Identification, authentication, and access controls | Products or services that control user access, for example with passwords, biometrics, or multi-factor authentication |

| Incident response and management | Helping other organisations react, respond, or recover from cyber attacks |

| Information risk assessment and management | Products or services that support other organisations to manage cyber risks, for example around security compliance or data leakage |

| Internet of Things | Products or services to embed or retrofit security for Internet of Things devices or networks |

| Network security | Hardware or software designed to protect the usability and integrity of a network |

| SCADA and Information Control Systems | Cyber security specifically for industrial control systems, critical national infrastructure, and operational technologies |

| Threat intelligence, monitoring, detection, and analysis | Monitoring or detection of varying forms of threats to networks and systems |

| Awareness, training, and education[footnote 8] | Products or services in relation to cyber awareness, training, or education |

Source: Ipsos, Perspective Economics and Centre for Secure Information Technologies

Further, we also classify each company by whether they provide (as their main cyber security offering) products, services, managed security services, or act as a cyber security specific reseller.

- Cyber security product(s): i.e. the business has developed and sells a bespoke product (hardware or software solution) to the market

- Cyber security service(s): i.e. the business sells a service to the market e.g. cyber security advisory services, penetration testing etc

- Provide Managed Security Services: i.e. the business offers other organisations some degree of cyber security support e.g. establishes security protocols, monitoring, management, threat detection etc – typically for a monthly or annual fee

- Resellers: i.e. the business packages and resells cyber security solutions (usually through licencing agreements)

This approach helps policymakers, industry, and investors understand how many companies there are focusing on a particular subsector of the market or offering new products or solutions accordingly.

2.3 Product and service provision

Figure 2.5 sets out an analysis of how many companies appear to be focused upon product or service provision. It is worth noting that in reality, there will be some overlap where firms provide both products and services; however, this approach selects one category per firm.

Overall, analysis of company trading descriptions suggests that over 7 in 10 (72%) of firms are mainly involved in service provision (including managed services and reselling), and just under 3 in 10 (28%) are mainly involved in cyber security product development.[footnote 9]

Figure 2.5: Number of registered cyber security firms by product/service focus

| Type | Percentage |

|---|---|

| Service | 56% |

| Product | 28% |

| MSSP | 16% |

| Reseller | 2% |

Source: Perspective Economics (n = 1,838)

Taxonomy breakdown

Within this study, we have matched company descriptions (in their own words through website analysis) with the key terms within each taxonomy category, followed by a manual check to assign companies to one (or more) taxonomy categories with respect to their product and service provision. Please note that the increase in company text data, and slight change to the taxonomy structure may impact the figures below from previous years.

On this basis, Figure 2.6 is based upon our analysis of trading descriptions. It demonstrates that ‘Cyber Professional Services’ remains the most commonly provided taxonomy category (75% of businesses, up from 72% last year), which reflects both the breadth of the taxonomy category as well as the often, lower barriers to entry in establishing an advisory business compared to creating and bringing a cyber security product to market.

Within the Cyber Professional Services category, we have also identified 561 firms (31%) offering support with GDPR compliance, ISO 27001 or Cyber Essentials accreditation, 215 firms (12%) providing cyber security design or advisory services (with respect to infrastructure etc) and 316 MSSPs (17%).

Figure 2.6: Number of registered cyber security firms by taxonomy offering

| Category | Percentage |

|---|---|

| Cyber Professional Services | 75% |

| Network Security | 65% |

| Endpoint Security | 57% |

| Threat Intelligence, Monitoring, Detection and Analysis | 54% |

| Information Risk Assessment and Management | 52% |

| Incident Response and Management | 33% |

| Training, Awareness and Education | 17% |

| Identification, Authentication and Access Control | 15% |

| IoT Security (incl. devices, automotive and access control) | 4% |

| SCADA and ICS | 2% |

Source: Perspective Economics, glass.ai (n = 1,838)

3. Location of cyber security firms (UK)

3.1 Introduction

This chapter explores the registered location (i.e. where each business has located its registered address with Companies House), and the active office locations (i.e. where each business has a trading presence or office across the UK) of cyber security firms.

Understanding the registered and trading addresses of cyber security firms in the UK enables regional analysis and supports the evidence-based identification of notable clusters or hotspots of activity. We have identified 3,818 office locations for the 1,838 firms identified within this study. In other words, on average, each firm has over two office locations across the UK (of which, one will be a ‘registered’ location with Companies House).

3.2 Location of UK Cyber Security Firms

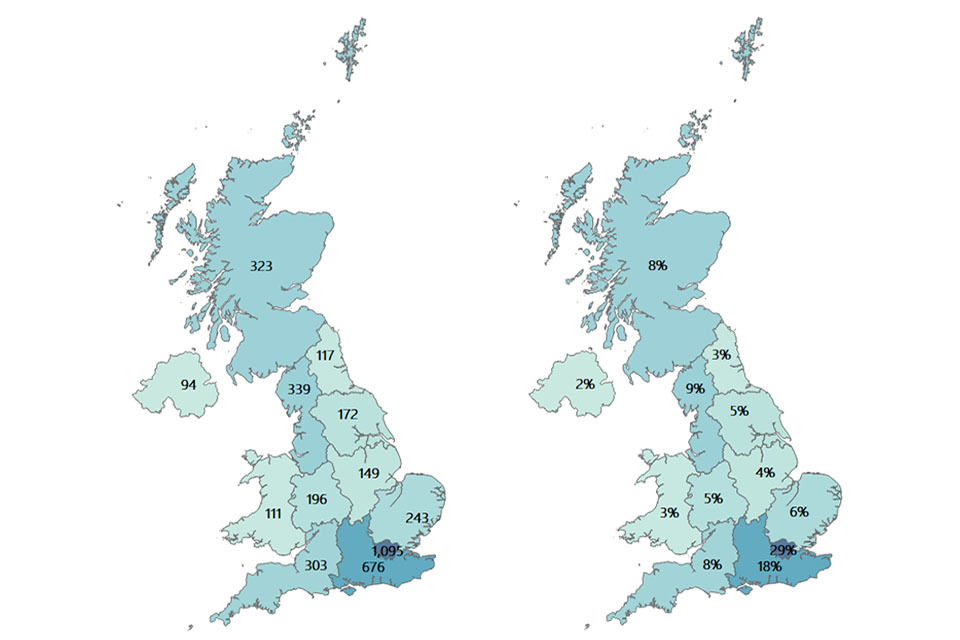

Figure 3.1 sets out the breakdown of firms by number of UK office locations identified in each of the twelve regions. This highlights the importance of identifying local units of activity in the UK (marked in blue below) when seeking to understand regional activity, as registered locations can be skewed towards London and the South East.

Figure 3.1: Percentage of cyber security firms by location

| Businesses | Percentage of Active Offices | Percentage of Registered Firms |

|---|---|---|

| Greater London | 29% | 33% |

| South East | 18% | 20% |

| North West | 9% | 7% |

| Scotland | 8% | 5% |

| South West | 8% | 7% |

| East of England | 6% | 7% |

| West Midlands | 5% | 5% |

| Yorkshire and the Humber | 5% | 4% |

| East Midlands | 4% | 4% |

| North East | 3% | 3% |

| Wales | 3% | 3% |

| Northern Ireland | 2% | 2% |

Source: Perspective Economics (n = 3,818 (all offices); n = 1,838 (registered offices))

Active (local offices)

Figure 3.2 sets out the number of active offices identified within this study by UK region. Overall, the data suggests a continuation of last year’s trend in that a slight majority of firms (53%) are based outside of London and the South East regions (compared to 54% last year). Further exploration of regional office data suggests no significant changes at the regional level; albeit with some growth noted in areas such as the North East (from 2% to 3% of offices) and the East Midlands (from 4% to 5%).

This may suggest that, as discussed in last year’s analysis, a recent shift to working-from-home practices, as a result of the COVID-19 pandemic may help to increase regional opportunities across the UK. Further, the DCMS Cyber Skills in the UK Labour Market research (2021) also highlights the significant increase in remote job postings advertised in cyber security roles across the UK. In other words, the presence of local offices (or remote presence) could yet further expand as employers’ increasing neutrality towards staff location may allow for firms to enter new geographical regions (e.g. a cyber security practice based in London recruiting staff working from home in Cardiff).

Figure 3.2: Active cyber security offices by region

Maps of UK showing number of active offices.

Source: Perspective Economics (n = 3,818)

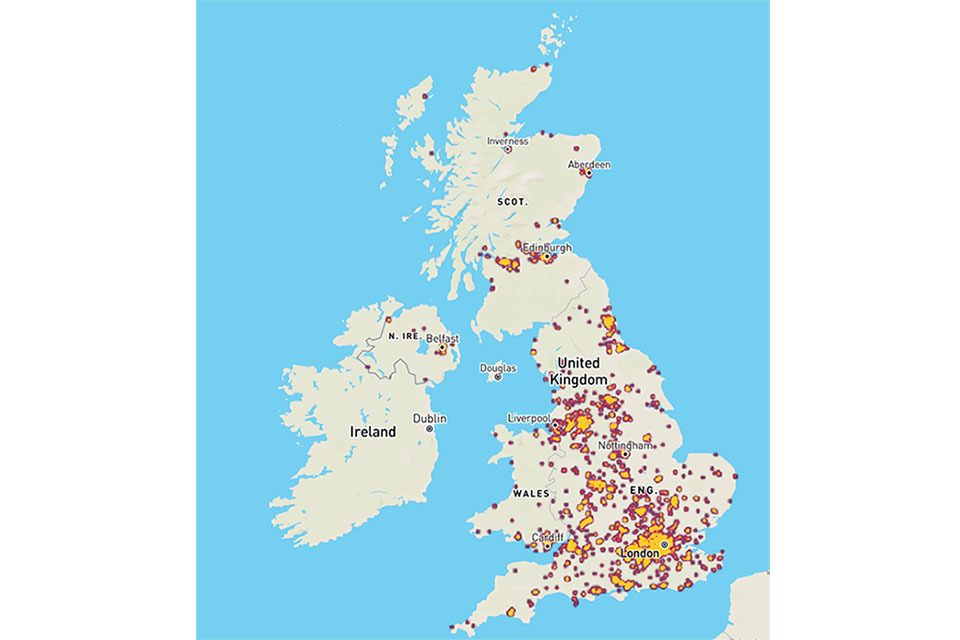

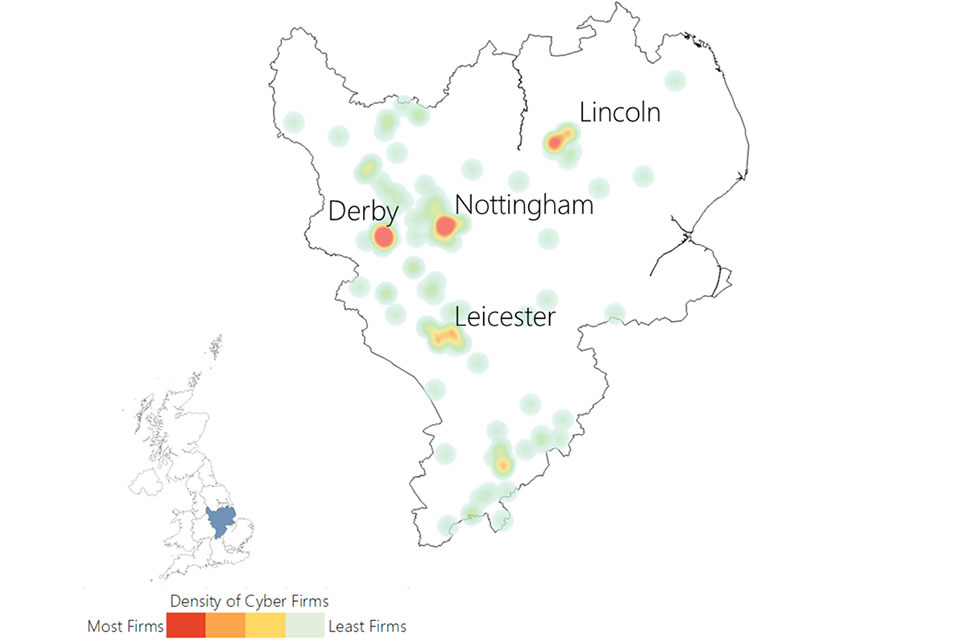

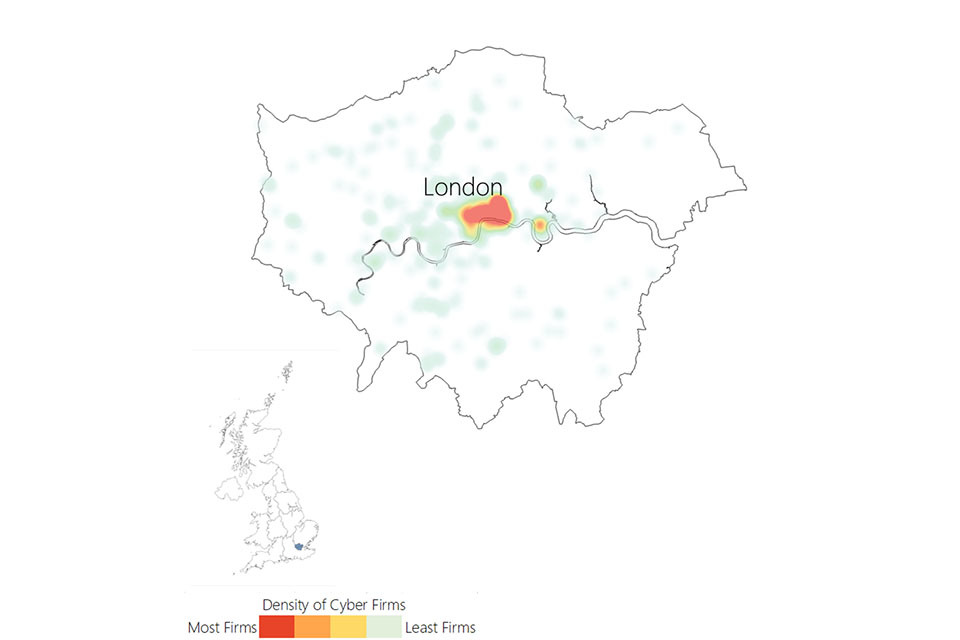

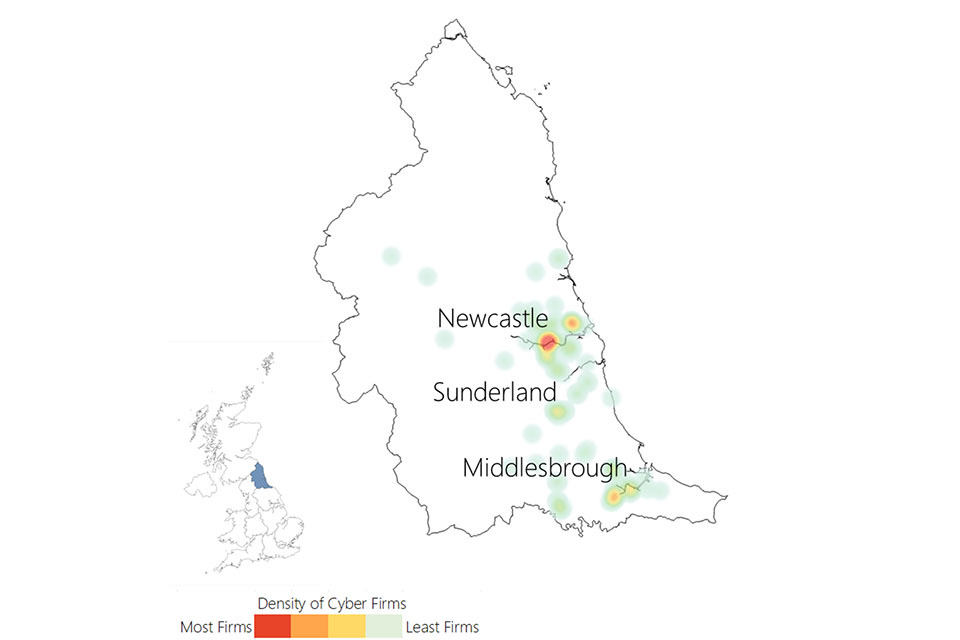

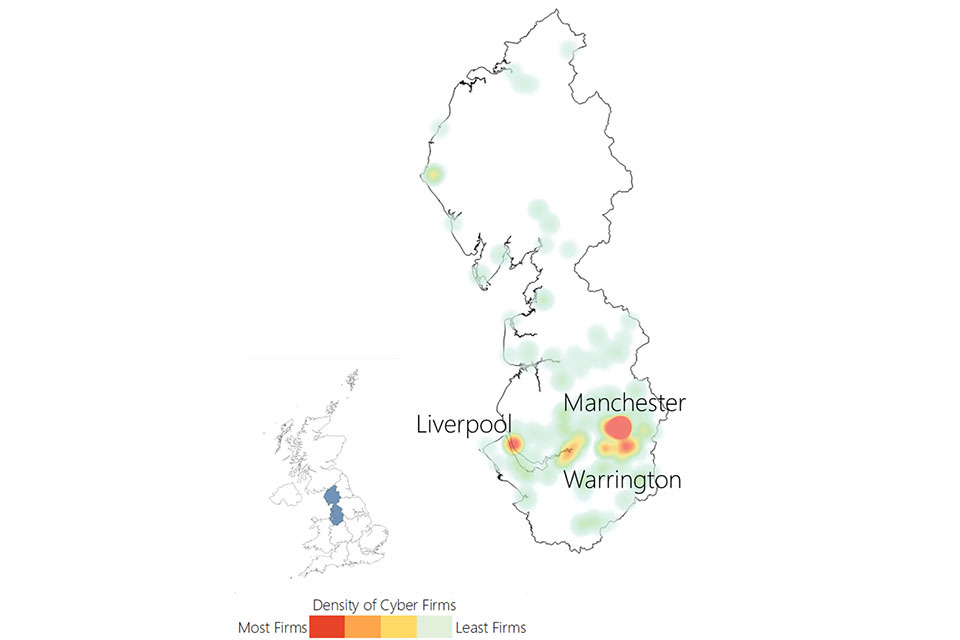

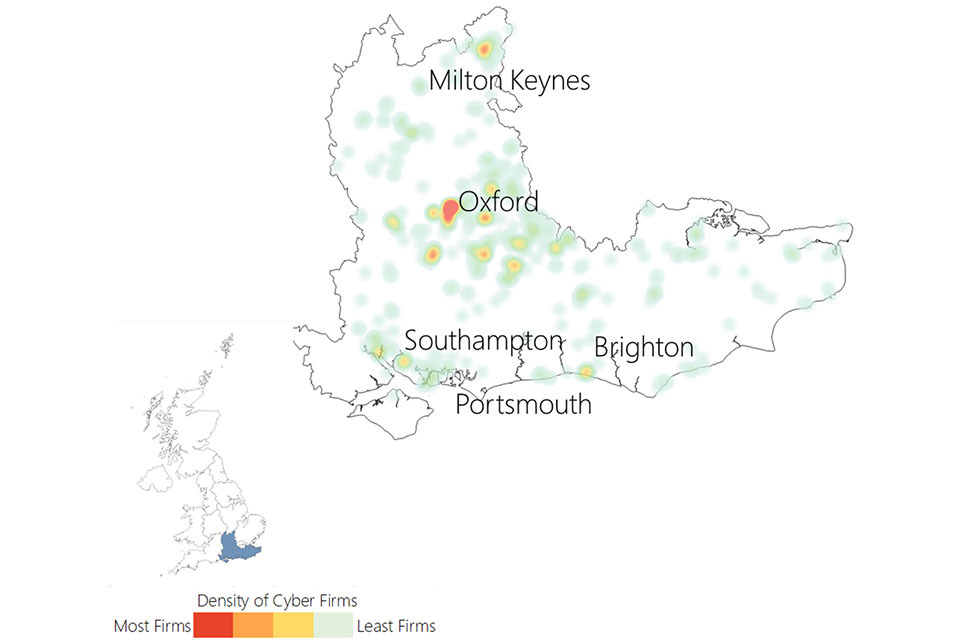

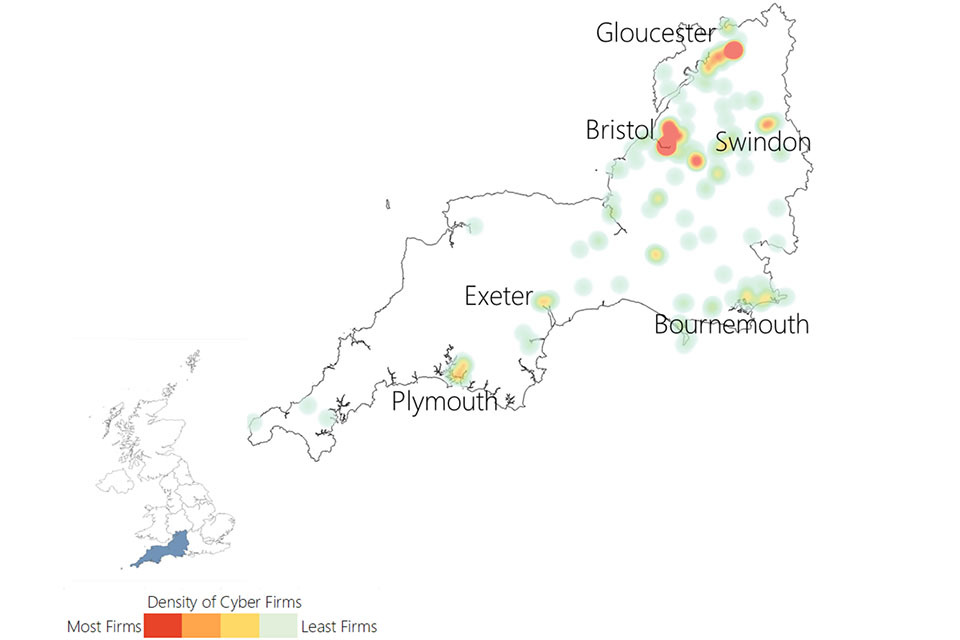

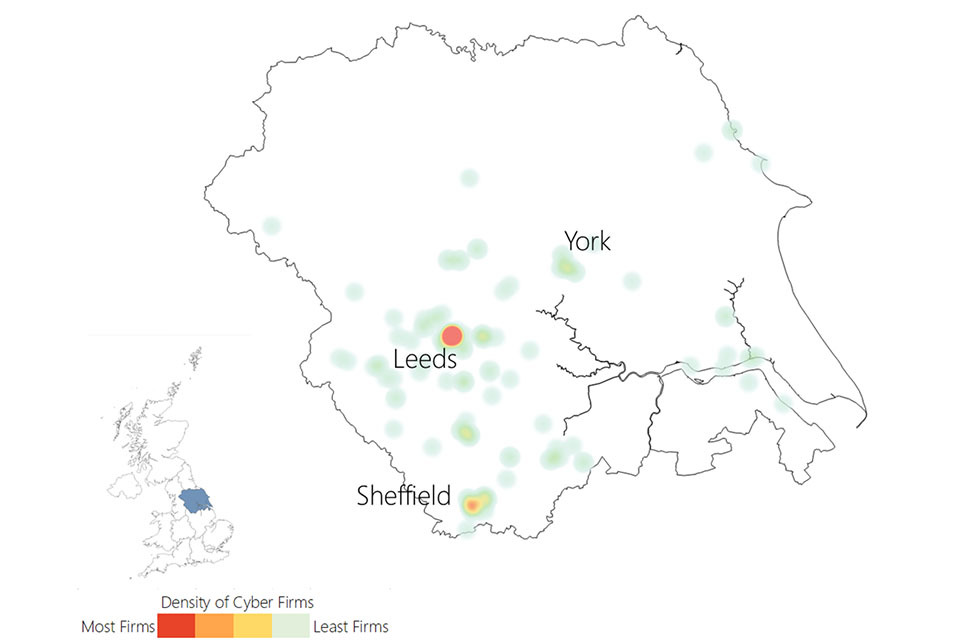

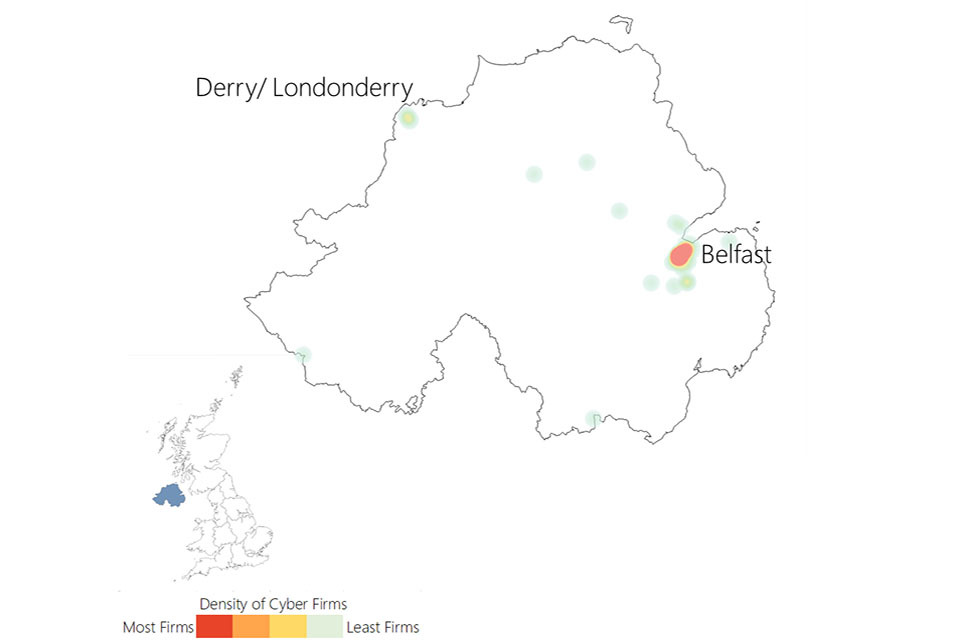

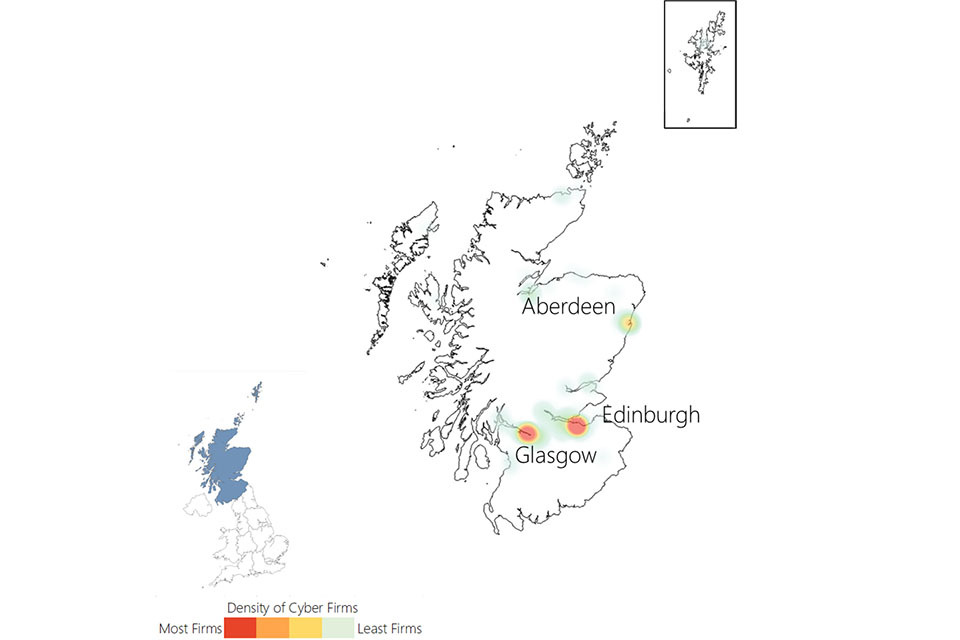

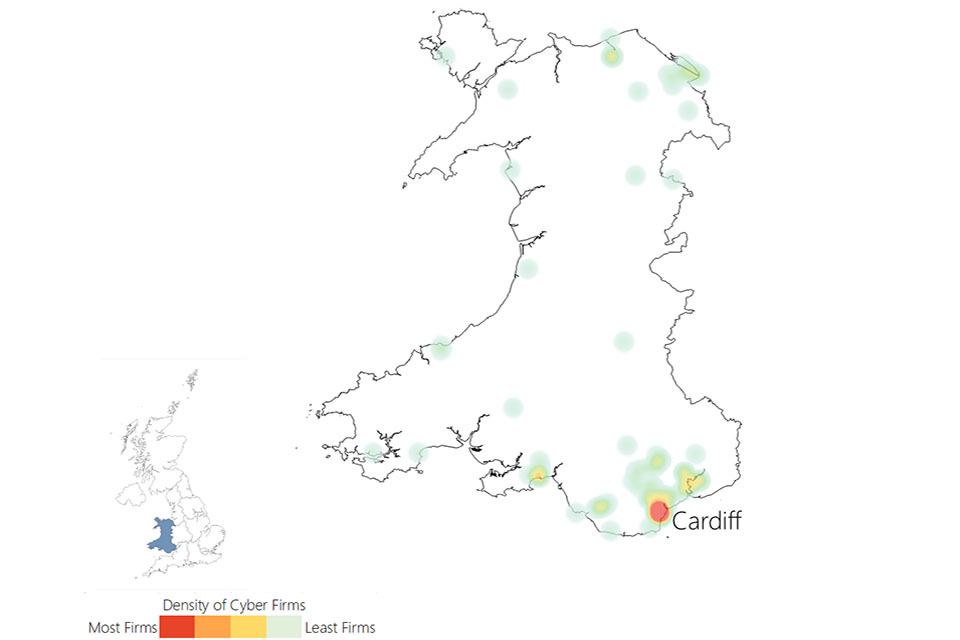

3.3 UK cyber security heatmap

In addition to understanding the number of offices across the UK for cyber security businesses, the research has identified the location of each office, and identified commercial clusters emerging. Heatmaps for each UK region are set out within the report annex.

Figure 3.3: Cyber security firm level heatmap

Cyber security firm level heat map of the UK. The greatest concentration of offices is in London and the South East.

Source: Perspective Economics (n = 3,818)

3.4 Role of cyber security clusters

DCMS works closely with regional cyber security clusters, supporting their development and improving reach and insight into local and regional cyber security sector ecosystems and opportunities for growth. Each of these clusters, and a regional snapshot is included within the annex of this report.

In July 2021, DCMS announced £850,000 of funding to support the establishment and activities of a new organisation called UK Cyber Cluster Collaboration (UKC3), which aims to support economic growth and skills development in the UK cyber security industry. UKC3 has a number of recognised clusters including Bristol & Bath Cyber Cluster, Cyber North, Cyber Wales, CyNam (Cyber Cheltenham), East of England Cyber Security Cluster, ScotlandIS Cyber, South West Cyber Security Cluster, Yorkshire Cyber Security Cluster, Midlands Cyber, North West, Swindon and Wiltshire, and NI Cyber, and this list is actively expanding across the UK’s regions.

Section 6.4 explores the level of business engagement with cyber security clusters and regional support bodies across the UK in further detail.

3.5 International activity

This section outlines where UK registered cyber security firms have an established physical presence in another country. This helps to inform a further understanding of where firms are exporting, are engaged in international markets, or where multinational firms have a presence in the UK. For the 1,838 providers of cyber security products and services, we have identified:

- 292 UK-headquartered cyber security businesses with a physical presence in international markets (denoted by an office presence); and

- A further 281 cyber security businesses active in the UK appear to be headquartered or originate from outside the UK

For the 292 UK-headquartered cyber security businesses, the following chart sets out the main trading regions (totalling to more than 100%, since firms have offices across multiple locations):

Figure 3.4: Regions with an international presence (by UK-headquartered cyber security firms)

| Region | Percentage |

|---|---|

| United States | 56% |

| European Union / European Economic Area | 46% |

| Australia | 17% |

| India | 13% |

| France | 13% |

| Germany | 12% |

| Singapore | 12% |

| Ireland | 12% |

| Netherlands | 10% |

| South Africa | 9% |

Source: Perspective Economics (n = 292 UK-headquartered firms with an international office presence)[footnote 10]

This suggests considerable growth in the number of UK firms operating with a presence in the United States (increased from 109 firms in last year’s study to 163). The European Union remains a key market, and 133 UK headquartered businesses have offices present across the European Union. In the last 12 months, there has also been increased activity by UK firms in India, Singapore, and South Africa.

In recent years, the UK has also been a clear international destination for foreign direct investment (FDI) in cyber security. We have identified where internationally headquartered firms (n = 281) have set up a presence in the UK (related to cyber security). In total, we have identified 183 firms from the United States that have set up an office in the UK (an increase from 167 last year). This accounts for 10% of all cyber security firms in the UK and highlights the importance of US-UK collaboration in this area. This is followed by 51 firms from across the European Union and European Economic Area (3% of cyber security firms operating in the UK), followed by 14 firms from Israel, 8 from Australia, and 6 from Canada.

4. Economic contribution of the UK cyber security sector

4.1 Estimated revenue

In the most recent financial year, annual cyber security revenue within the sector is estimated at £10,146 million (rounded to £10.1 billion). This reflects an increase of 14% from last year’s study (£8.9 billion).[footnote 11]

Please note that:

- The inclusion of glass.ai (and enhanced engagement with third parties) has helped to identify more businesses at an early/micro stage, and those diversified firms with a cyber security presence. This has helped to boost the number of active firms from 1,483 to 1,838

- However, this also demonstrates that previous studies have captured the most prevalent providers of cyber security products and services - as the firms identified last year cover 94% of the revenue, 93% of the Gross Value Added (GVA), and 94% of the employment

- The 1,386 firms within last year’s study that remain active today have grown their estimated cyber related revenues from £8.2 billion to £9.5 billion (increase of 16%) - i.e. we perceive that sectoral revenue growth is being driven by these established providers

- Therefore, we are confident in the estimated 14% increase in cyber security sector revenues (i.e. from £8.9 billion to £10.1 billion)

This figure is estimated using:

- Revenue figures available for dedicated (100%) cyber security firms that publish annual accounts

- Revenue figures available for diversified cyber security firms (multiplied by the estimate of the proportion of the firm’s activity related to cyber security)

- Reported cyber security revenue estimated (for the most recent financial year) through the cyber sector survey held in Summer 2021

- Where gaps exist, employment has been sourced or estimated, with revenue estimated using ‘revenue per employee’ (estimated by size using known data) multiplied by ‘number of employees’ to provide an estimated revenue figure on a firm-by-firm basis

This revenue estimate relates to revenue attributable to cyber security activity only. The following subsections set out revenue by size, revenue by size and dedicated/diversified categorisation, and revenue by key company offer. Please note that as the analysis was undertaken in late 2021. We use the most recent financial year reporting data where possible, which means that much of the revenue will have been achieved through work delivered and billed in 2020 (e.g. if a company has a financial year ending March 2021, those accounts will reflect billed work from April 2020 – March 2021).

In this respect, these figures can be considered relevant to the financial impact of COVID-19, and may reflect the receipt of government support, and potential for increased revenues (through clients moving to remote working etc.), and potentially reduced costs (e.g. through reduced travel, office costs, rates subsidies). This is also reflected in the increase in GVA estimate (Section 4.3).

Revenue by firm size

We estimate that three-quarters (£7.6 billion, 75%) of all UK cyber security revenue is earned by large firms (which further demonstrates the earning power of these firms given that they reflect 8% of all market providers).

This includes several very large providers of telecommunications, aerospace, defence and security, and consultancies for which the size and scale of their respective cyber security product and service divisions reflect a considerable proportion of the wider market.

Medium firm revenues have softened (14% of the sector’s revenues), with a slight decline from £1.56 billion (18%) to £1.38 billion (14%). However, this may also be attributable to some existing medium firms scaling from medium to large. This continues to suggest that a competitive mid-market is in place, particularly where firms in receipt of external investment have been able to scale and service the market accordingly.

Small and micro firms have experienced considerable relative growth in the previous year.

Small firms have increased their cyber security related revenues from £527 million (then 6% of revenues) to £857 million (now 8% of revenues). Further, average small firm cyber security related revenues have grown from approximately £1.6 million to £1.9 million (i.e. on average, small cyber security firms have experienced an increase of 19% in revenue within the last financial year, and their annual growth has outstripped that of the wider market).[footnote 12]

Micro firms have also increased their cyber security related revenues from £217 million (then 2% of revenues) to £313 million (now 3% of revenues). Average micro firm cyber security related revenues have grown from approximately £260,000 to £300,000 (i.e. on average, micro cyber security firms have experienced an increase of 15% in revenue within the last financial year).[footnote 13]

Figure 4.1: total cyber security revenue by size of firm

| Size | Revenue |

|---|---|

| Large | 75% (£7,599m) |

| Medium | 14% (£1,376m) |

| Small | 8% (£857m) |

| Micro | 3% (£313m) |

Source: Perspective Economics (n = 1,838)

Segmentation of revenue by both size and by whether the firm is understood to be ‘dedicated’ or ‘diversified’ also provides an interesting overview of which firms are driving the revenue within the sector.

This highlights that ‘diversified’ firms continue to generate significant revenues through their cyber security offer. For Small and Medium Enterprises (SMEs), dedicated cyber security firms generate the greatest proportional revenue (e.g. 85% of revenues for medium firms, 89% for small, and 94% for micro firms).

Figure 4.2: Total cyber security revenue by size by dedicated/diversified status

| Businesses | Dedicated | Diversified |

|---|---|---|

| Large | £2,596m | £5,003m |

| Medium | £1,176m | £200m |

| Small | £763m | £95m |

| Micro | £293m | £20m |

Source: Perspective Economics (n = 1,838)

This suggests that the UK market remains home to:

- Approximately 20 ‘anchor’ large and diversified firms, which are estimated to generate over £50 million each in cyber security revenues. This can often be a very small proportion of the firm’s revenues (often in £ billions) but reflects a significant proportion of the UK’s cyber sector

- A significant ‘dedicated’ and growing middle market: There are now 84 firms (an increase from 72 last year) that we have identified as dedicated providers of cyber security with over £10 million in annual revenues

Finally, segmentation of revenues by size and by those companies that either provide (as a core role) cyber security products, services, managed security services, or resell (set out in Figure 4.3) also provides some useful insight.

Overall, service providers (including Managed Service Providers (MSPs) and Managed Security Service Providers (MSSPs)) are generating approximately £5.8 billion in cyber security related revenues. This reflects an increase of c. 12% since last year’s study.

Product companies have continued to perform strongly in the last 12 months, with respective revenues increasing from c. £3.4 billion to c. £4.2 billion (an increase of 19%). This suggests a sustained trend of companies towards product / subscription-based solutions in the market.

Figure 4.3: Total cyber security revenue by size and by offering

| Business | Large | Medium | Small | Micro | Total |

|---|---|---|---|---|---|

| Product | £2,935m | £802m | £337m | £105m | (Total: £4.2bn) |

| Service | £2,828m | £371m | £415m | £179m | (Total: £3.8bn) |

| MSSP | £1,658m | £189m | £102m | £29m | (Total: £2bn) |

| Reseller | £179m | £14m | £4m | £1m | (Total: £0.2bn) |

Source: Perspective Economics (n = 1,838)[footnote 14]

4.2 Estimated employment

We estimate that there are 52,727 Full Time Equivalents (FTEs) working in a cyber security related role across the 1,838 cyber security firms identified. Please note that this figure only relates to the number of estimated FTE cyber security professionals working within cyber security sector firms.

This reflects an increase of 13% (up from 46,673 last year) in employee jobs within the last 12 months (and the rate of this increase is higher than the previous year’s employment growth figure of 9%). In other words, the sector has added over 6,000 FTEs in the past year.

This suggests that the number of employees working within the cyber security sector has grown significantly in 2020/21 and is also reflected in the considerable growth in cyber security job posting rates identified in the Cyber Skills in the UK Labour Market research.

Company level employment is initially estimated at the registered level (i.e. this suggests concentrated employment within Greater London and the South East is 76% of the UK figure). However, as this reflects employment at a registered level, this has the effect of underestimating employment for the other regions, whereby employers have employees across the UK. For example, firms registered in Northern Ireland hire an estimated c. 600-700 people within cyber security, but the region is home to an estimated c. 2,300 cyber security professionals. As such, in Figure 4.4, we provide the registered and estimated actual employment breakdown by region. This estimate draws upon Perspective Economics modelling of key regional employers.

Figure 4.4: Estimated cyber security employment by region

| Businesses | Estimated Regional Employment | Registered Employment |

|---|---|---|

| Greater London | 29% | 41% |

| South East | 16% | 35% |

| North West | 9% | 5% |

| South West | 8% | 3% |

| Scotland | 7% | 2% |

| West Midlands | 7% | 1% |

| East of England | 6% | 8% |

| Yorkshire and the Humber | 5% | 2% |

| Northern Ireland | 4% | 1% |

| Wales | 4% | 1% |

| East Midlands | 3% | 1% |

| North East | 2% | 1% |

Source: Perspective Economics (n = 52,727 FTEs, estimate)

Analysis of estimated cyber security employment by company size (Figure 4.5) demonstrates that, in line with last year’s findings, most cyber security employment remains concentrated within large firms (64%). The average size of a cyber security team has fallen slightly this year from 31 staff to 29 staff. Indeed, across the size brackets, average team size has remained consistent with last year’s figures. This suggests that whilst the total workforce has increased, there may be a tightening labour pool and enhanced competition among employers for new talent.

Figure 4.5: Estimated cyber security employment by size of firm

| Size | Number Employed |

|---|---|

| Large | 33,630 |

| Medium | 9,357 |

| Small | 6,738 |

| Micro | 3,002 |

| Grand Total | 52,727 |

Source: Perspective Economics (n= 52,727)

Figure 4.6 sets out employment segmented by ‘Dedicated’ and ‘Diversified’ firms. This suggests that employment growth has been most pronounced within ‘dedicated’ firms.

When compared to last year’s estimates, the number of cyber security jobs within dedicated providers has increased from 25,241 FTEs to 29,897 (an increase of 4,656, or +18%), compared to a lower relative increase for diversified firms from 21,262 FTEs to 22,830 FTEs (an increase of 1,568, or +7%).

This may suggest an increased demand for additional resource and talent among some of the dedicated cyber security providers in the UK, and it will be important to explore this trend in future years.

Figure 4.6: Estimated cyber security employment by dedicated / diversified

| Type | Employment (Percentage) |

|---|---|

| Dedicated | 29,897 (57%) |

| Diversified | 22,830 (43%) |

Source: Perspective Economics (n = 52,727)

Finally, Figure 4.7 sets out employment segmented by company core offering. Just under two-thirds (63%) of employees work within a company that primarily offers cyber security services or managed services, compared to 36% that work primarily within a product environment.

The number of staff working within product companies has increased from 15,278 last year (33% of all staff) to 18,813 (36% of this year’s employment figure). This reflects previous year’s trends and may highlight a drive for increased employment within dedicated product firms in the UK.

Figure 4.7: Estimated cyber security employment by offering

| Type | Employment (Percentage) |

|---|---|

| Service | 23,990 (45%) |

| Product | 18,813 (36%) |

| MSSP | 9,568 (18%) |

| Reseller | 356 (1%) |

Source: Perspective Economics (n = 52,727)

Estimated Gross Value Added (GVA)

Gross Value Added (GVA) is used as a measure of productivity (at a firm level, or above). It captures the sum of a firm’s Gross Profit, Employee Remuneration, Amortisation and Depreciation. In this respect, any increase in GVA can highlight an improvement in the performance of a firm or a sector, as evidenced through higher profitability or enhanced earnings.

We estimate that within the most recent financial year, cyber security related GVA (for the 1,838 firms) has reached £5.3 billion (an increase of 33% since last year). This is a substantial increase and reflects improved profitability and remuneration across the firms.

Figure 4.8 sets out an overview of GVA (compared to revenue) by size of firm.

Overall, this data suggests an improved GVA-to-turnover ratio of 0.52:1 (i.e. for every £1 of revenue the sector generates, 52p in direct GVA is generated, compared to 46p last year).

Figure 4.8: Total cyber security revenue and GVA by size of firm

| Businesses | Estimated Cyber Security Related Revenue | Estimated Cyber Security Related GVA |

|---|---|---|

| Large | £7,599m | £3,739m |

| Medium | £1,376m | £754m |

| Small | £857m | £551m |

| Micro | £313m | £250m |

Source: Perspective Economics (n = 1,838)

4.4 Summary of economic contribution

The table below sets out the key findings regarding the economic contribution of the UK’s cyber security sector.

| Size | Number of Firms | Estimated Revenue (Cyber Security Related) | Estimated GVA (Cyber Security Related) | Estimated Employment (FTE) (Cyber Security Related) | Estimated Revenue per employee | Estimated GVA per employee |

|---|---|---|---|---|---|---|

| Large | 156 | £7,599m | £3,739m | 33,630 | £225,959 | £111,180 |

| Medium | 184 | £1,357m | £780m | 9,357 | £147,086 | £83,341 |

| Small | 447 | £857m | £556m | 6,738 | £127,235 | £82,542 |

| Micro | 1,051 | £313m | £251m | 3,002 | £104,364 | £83,762 |

| Grand Total | 1,838 | £10,146m | £5,326m | 52,727 | £192,423 | £101,019 |

Overall, since last year’s study, the following changes to the key metrics are noted:

- The number of active cyber security firms (tracked in this study) has increased from 1,483 to 1,838

- Cyber security related revenues for these firms has increased from £8.9 billion to £10.1 billion (an increase of 13%)

- Cyber security related GVA for these firms has increased from £4 billion to £5.3 billion (an increase of 33%)

- Estimated revenue per employee has increased slightly, from c. £190,000 to c. £192,000 (an increase of 1%)

- Estimated GVA per employee has increased from c. £86,000 to c. £101,000 (an increase of 17%). This is higher than the current estimated GVA per employee for the DCMS Digital Sector (DCMS Economic Estimates) of £95,000 per employee.[footnote 15]

Sources: DCMS (2020) DCMS Economic Estimates 2019: Gross Value Added and DCMS (2020) DCMS Economic Estimates 2019: Employment

5. Investment in the UK cyber security sector

5.1 Introduction

This section draws upon the Beauhurst platform which tracks announced and unannounced investments in high-growth companies from across the UK. Our team has matched Company Registration Numbers and Company Names identified within this current analysis with the platform to identify 976 investments[footnote 16] in 322 tracked companies.

In other words, approximately 1 in every 6 firms identified within our analysis has received some form of external investment. This chapter focuses on investment activity within the full year of 2021 (1st January – 31st December).

5.2 Investment to date

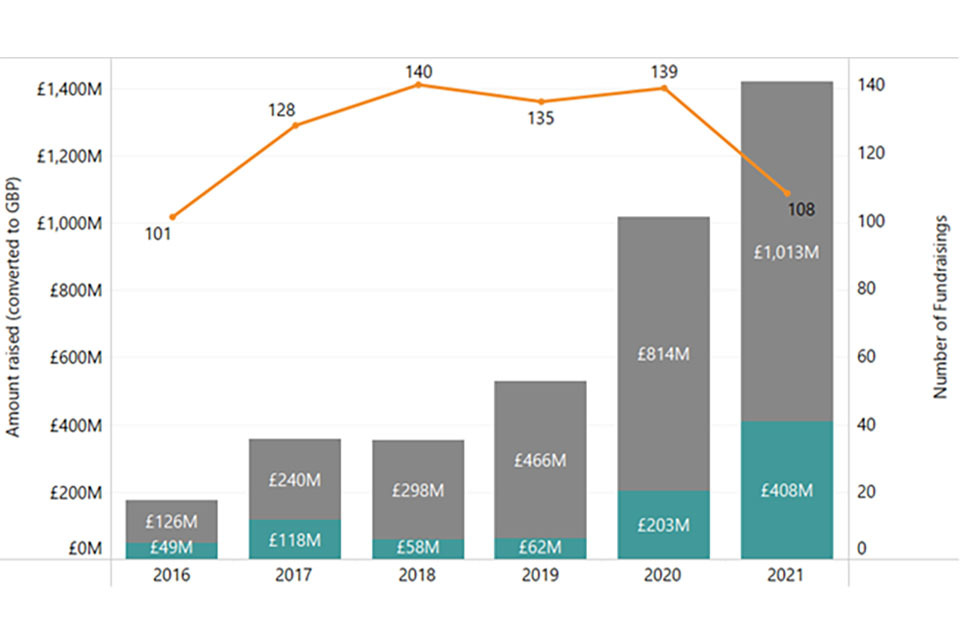

The investment timeline (Figure 5.1) demonstrates that 2021 has been a record year for cyber security investment, with over £1.4 billion raised in 2021 across 108 deals. This includes £1,013 million raised across 84 deals within dedicated cyber security firms, which we focus on subsequently.

Further, the total amount raised by the sector has almost doubled in 2020 compared to 2019 for dedicated cyber security firms (£814 million in 2020 and £466 million in 2019). Please note all following analysis focuses upon investment in dedicated cyber security firms.

Figure 5.1: Investment timeline

Bar chart showing investment in cyber security firms by dedicated / diversified status from 2016 to 2021. Overall, investment is increasing year-on-year. The key insights are included in the two paragraphs before the chart.

Source = Beauhurst (note, blue = diversified, grey = dedicated, orange = number of deals)

Within 2021, there were a number of notable investments raised by dedicated cyber security companies in the UK. Some examples include:

- Snyk, an application and developer security platform, raised two investments in 2021, including a $530 million (c. £400 million) Series F investment co-led by Sands Capital and Tiger Global. This gives the company a post-money valuation of c. $8.5 billion

- OneTrust, a privacy, security, and governance platform. announced a $210 million Series C extension in April 2020

- Immersive Labs, based in Bristol provides online training and gamified labs for cyber security education. In June 2021, they raised £53.5 million in external investment

- Tessian develops software to detect phishing, unauthorised emails and prevent cyber security threats, and raised over £52 million in 2021

- B-Secur develops technology designed to enable the reading of an individual’s heartbeat pattern through their fingerprint, enabling the verification of their identity. They announced an equity fundraising of £8.8 million in November 2021.

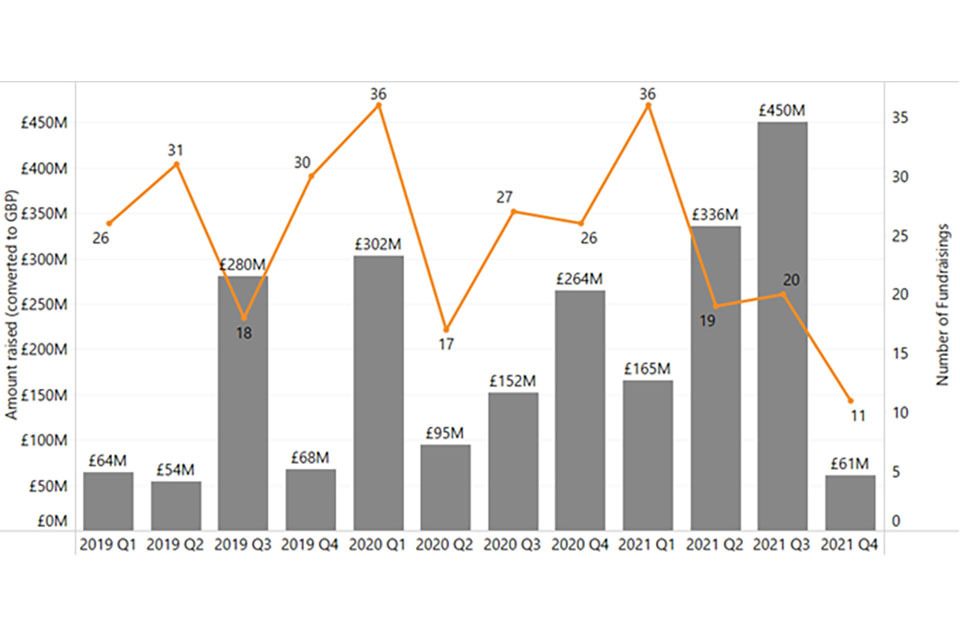

Figure 5.2 also highlights that Q2 and Q3 2021 were particularly strong, with £336 million and £450 million raised by dedicated cyber security companies, respectively.

Figure 5.2: Investment timeline (Quarterly, dedicated cyber Security investment)

Bar chart showing investment raised by dedicated cyber security companies in each quarter from Q1 in 2019 to Q4 in 2021. The key insights are included in the paragraph before the chart.

Source: Beauhurst

5.3 Investment by location

External investment is a key indicator for business performance, as investment can help businesses to build their platforms, secure talent, and continue to grow, thereby helping to increase economic prosperity. It is crucial that businesses across the UK are able to secure investment where desired, in order to help provide the capital to scale and grow.

Figure 5.3 sets out an overview of investment performance within cyber security by UK region, with respect to value and volume of investment. This highlights that, as with previous years, the majority of investment raised (91%) is within cyber security firms based in London and the South East. Indeed, as with the previous study, 8 of the UK regions generate less than 1% of the UK total each, which highlights significant disparity with respect to large scale investments.

However, some of the regions continue to demonstrate multiple early-stage cyber security deals in their area, suggesting that sustained support for these start-ups may help to increase the value of rounds raised by cyber security firms across the regions. This is starting to be seen in areas such as the South West, where only 3% of the UK’s investment deals took place, but these deals represented 6.2% of the total value raised in 2021 (due to the significant growth in Bristol-based Immersive Labs). In this respect, many of the regions may be home to early-stage companies that could be feasibly supported to secure Series A (or higher) level investment in the upcoming years.

Figure 5.3: Total Investment (value and volume, 2021)

| Region | Value - Amount Raised (Percentage) |

|---|---|

| South East | £462.5m (45.7%) |

| Greater London | £457.5m (45.2%) |

| South West | £62.4m (6.2%) |

| Northern Ireland | £10.9m (1.1%) |

| Scotland | £5.2m (0.5%) |

| North East | £4.2m (0.4%) |

| East of England | £4.1m (0.4%) |

| North West | £3.8m (0.4%) |

| East Midlands | £0.9m (0.1%) |

| West Midlands | £0.8m (0.1%) |

| Wales | £0.4m (0.05%) |

| Region | Volume - Percentage (number of deals) |

|---|---|

| Greater London | 40% (34 deals) |

| South East | 21% (18) |

| North West | 10% (9) |

| Northern Ireland | 7% (6) |

| East of England | 6% (5) |

| North East | 5% (4) |

| South West | 3% (3) |

| Scotland | 3% (3) |

| East Midlands | 2% (2) |

| West Midlands | 1% (1) |

| Wales | 1% (1) |

Source: Beauhurst (2021)

5.4 Investment by size

Figure 5.4 sets out the volume of investment by (current) company size within the cyber security sector in 2021. The previous study set out that in 2020, only 7% of investment was raised by small and micro level firms (i.e. fewer than 50 staff). In 2021, this has increased to 15% of total investment raised, reflecting increased demand among investors for backing early-stage UK cyber security firms. For example, in 2021, firms such as Hack the Box (£7.7 million), Cado Security (£7.3 million) and Venari Security (£4.2 million) have all successfully raised investment.

This is further highlighted in Figure 5.5, which highlights the growth in the amount of investment secured for venture stage companies (from £41.7 million across 32 deals in 2020, to £114 million across 36 deals in 2021). This suggests signs of a sustained maturity within the UK’s cyber security investment ecosystem, with high-growth firms able to secure investment and use this as a catalyst to expand their teams and operations.

Figure 5.4: Total investment by company size (2021)

| Size | Percentage |

|---|---|

| Large | 15% (£152.8m) |

| Medium | 70% (£711.4m) |

| Small | 11% (£111.6m) |

| Micro | 4% (£36.9m) |

Source: Beauhurst (2021)

Figure 5.5: Total investment by stage of evolution[footnote 17] (2021)

| Size | Percentage |

|---|---|

| Large | 15% (£152.8m) |

| Medium | 70% (£711.4m) |

| Small | 11% (£111.6m) |

| Micro | 4% (£36.9m) |

Source: Beauhurst (2021)

5.5 Investment by company type

Figure 5.6 highlights how investment preference for companies that primarily offer cyber security products has continued in 2021, with 76% of the volume of investments, and 93% (£945 million) of the respective investment value.

Figure 5.6: Investment by product / service offer (2021)

| Type | Percentage (Count) |

|---|---|

| Product | 76% |

| Service | 19% |

| MSP | 6% |

| Type | Percentage (Amount Raised) |

|---|---|

| Product | 93% (£945m) |

| Service | 6% (£56m) |

| MSP | 1% (£12m) |

Source: Beauhurst (2021)

5.6 Investors and sources of funding

Overall, looking at the investments secured by the identified cyber security companies, Beauhurst data indicates that:

- Within all the historic cyber security fundraising data, there have been 513 funds involved, of which 83% are still active. This is a substantial increase from the 2017 baseline report (whereby 68 funds were identified), and from last year, where 283 funds were involved within the historic fundraising data. This suggests that as the UK’s cyber security investment ecosystem has matured and scaled, many fundraisings contain multiple investment funders to provide this capital

- Further, within last year’s analysis, there were 24 funds that could provide more than £25 million (based upon typical investment activity or known sector / investment restrictions). This has since increased to 35 funds, again reflecting further maturity within the investment landscape

Within the UK, some of the most significant investors continue to include (by value / volume):

- 24Haymarket

- Accel

- AlbionVC

- British Patient Capital

- Amadeus Capital Partners

- IQ Capital

- Mercia Asset Management

- Octopus Ventures

- Paladin Capital Group

5.7 Market dynamics: qualitative feedback

In August and September 2021, the research team held a series of qualitative consultations with a range of industry investors to gather views about what investors are looking for in UK cyber security, and perceptions of the investment landscape.

Main factors driving investment

Investors spoke of a number of factors driving their investment decisions.

One factor was market opportunity. The investors that participated in this research looked for products or services that they considered to be innovative and in growth areas, such as Internet of Things, cloud computing, supply chain security and smart cities.

We will turn down very good businesses even if we think they are $100 million to $500 million. They don’t fit with the investment mandate of future public companies with multi-billion revenues.

- Cyber security investor

There were investors who felt other areas such as network and endpoint security were already crowded markets, or that some areas such as hardware security and quantum computing needed ‘de-risking’ through government support. In terms of exports, there was little consistent feedback, although one investor felt that UK businesses were more ‘investment-ready’ if they exported to the US specifically, given the size and importance of the US market.

Different investors in the cyber investment market focused on different growth stages or levels of maturity. For example, one investor who focused on late-stage investment looked for companies that had already raised seed and series A and B funding, and that had potential to become multi-billion revenue public companies; while another investor focused on those looking for seed or series A funding, and so looked for companies with much lower revenues.

However, regardless of maturity, investors reported wanting to see businesses with a strong roadmap for growth. One investor commented that they like to see companies where intellectual property (IP) rights have already been granted.

Good companies are those with a really strong product roadmap and the potential to move into adjacent markets and industries with a broader offer. Coming with a vision for how they can build a very large business is key.

- Cyber security investor

The experience of the company’s team was also important to investors who focused on more mature businesses. Investors reported looking for businesses that did not just have technically gifted teams (in terms of technical cyber security skills), but who were also exceptional entrepreneurs. This involved businesses being able to demonstrate commercial traction, for example, having experience of attracting large or established customers and an exceptional rate of attraction.

However, investors reported it was also key for a business to have validation of their product or service from sophisticated buyers. This was important to investors due to the challenges with validating the uniqueness and defensibility of cyber technologies given the number of companies and products in the ecosystem.

In cyber, we’re prepared to drop the £500,000 limit [lower revenue limit] and even go pre-revenue provided they have validation from sophisticated buyers and companies with sophisticated procurement processes who have engaged with and used the product in pilot or full-scale implementation and can vouch for the team and that the product works.

- Cyber security investor

How investors support cyber sector businesses

Investors described supporting cyber sector businesses in various ways.

Investors emphasised the importance of getting the right people into the organisation, both in terms of technical talent and sales talent. The investors that participated in this research noted that start-ups can find it challenging to access technical talent as they are unable to compete with established businesses or in Big Tech and in the Fin Tech sector.

Access to talent is still a huge issue. There is lots of talent, but start-ups are finding it hard to compete on compensation, stability, and risk. Software engineering, AI and machine learning are in hot demand from Big Tech, FinTech, etc.

- Cyber security investor

Investors also noted that many founders struggle with sales and scaling their business. Investors with in-house teams reported supporting scaling and recruitment (of both technical and sales talent) through headhunting, advising on recruitment practices and culture, and advising on business structure to facilitate growth.

Larger investors reported offering mentoring and networking support. For example, one investor typically joined the Board of Directors to provide experience, act as a “strategic sounding board” for founders and allow cyber businesses to access the network of their portfolio around the world. This facilitated business development through customer introductions and connecting entrepreneurs with peers. This visibility – connecting successful entrepreneurs – was suggested as another way the government could support the cyber sector.

I think it would be great for the government to continue to celebrate success stories.

- Cyber security investor

Views of the UK as an investment landscape for cyber security

Investors were positive about the UK as an investment landscape for cyber security, although they identified some economic challenges facing the sector.

Investors viewed the UK cyber security sector as a high growth sector attracting a lot of investment, particularly compared to the rest of Europe, though it was still felt to be behind the US and Israel.

I think the UK is probably the best place in Europe [for cyber security investments], but I feel it’s behind Israel and behind the US in terms of opportunities … The UK is far ahead of the rest of Europe in terms of scale-up potential companies.

- Cyber security investor

On the whole I think it’s a sector which is well supported, and investors are excited to be supporting.

- Cyber security investor

However, the UK cyber security sector was also described as being heavily crowded, meaning that high visibility, and strong sales and marketing were particularly important.

This reflects the global picture, with recent research suggesting the world’s largest cyber security firms are spending 41% on average of their revenue on their commercial activities. As this external research highlights, the information asymmetry between vendors and buyers presents an economic (rather than a technological) challenge: buyers find it difficult to evaluate cyber security technologies, which incentivises vendors to bring sub-optimal solutions to the market. To counter this, independent regulation and transparent efficacy assessments of technologies are suggested to reduce the information asymmetry and build customer trust and confidence in cyber security solutions.

In our interviews, there were some investors who felt the government could do more to support businesses working in fundamental technology where development timescales are too long to be appealing to the traditional venture market.

Government help is particularly needed on companies which are maybe not a traditional venture case and that could, for example, be around fundamental technology – hardware innovation, deep technology – which takes years to develop before it has any commercial implications. I think that’s where the traditional venture market is not well set up to support.

- Cyber security investor